After stringent lockdowns and economies in freefall earlier in the year, the long road to recovery is underway. Economic data has since May 2020 already surprised on the upside and a strong rebound should be in evidence during the remainder of the year. The globe has experienced a major shock both medically and economically and it may take several years to return to the pre-pandemic experience.

Containing the coronavirus has proven highly challenging. Local lockdowns and social distancing could endure longer than expected. These have less macroeconomic impact. Several areas are aiming to control the virus at a low level, suppressing spot outbreaks. Returns to country-wide stoppages appear unlikely.

Business failures and higher unemployment levels are more likely in the areas most directly impacted by the crisis such as energy, retail and travel. It will take several years for these sectors to regain the activity levels experienced at the start of this year.

Unfortunately, emerging markets such as Brazil, India and Mexico continue to face rising new cases. The economic impact in emerging markets is likely to be more severe than in advanced nations due to weaker medical infrastructure and social safety nets, relatively high reliance on international economies through exports and limited capacity for domestic economic support through monetary and fiscal actions.

Companies are dynamically discovering how to progress through this challenging period and come out the other side in better shape. Many will be more streamlined, nimble and make better use of technology. Lower wages and other input costs will add to profit margins. The financial system appears sound. Banks are better capitalised than in 2008 and widespread deleveraging or loan losses appear less likely.

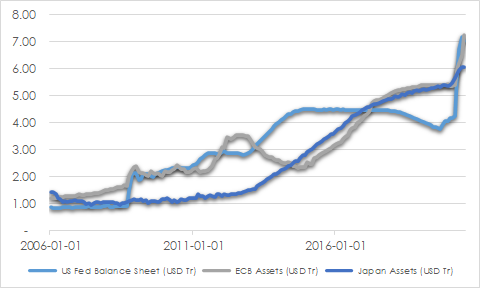

Additional monetary accommodation can be expected should it be needed though interest rates at or around zero limit further policy options. The US Federal Reserve since mid-March 2020 has cut interest rates to zero and expanded the size of its balance sheet by more than USD 3 trillion by buying government securities and, for the first-time, corporate bonds.

The target overnight interest rate is likely to remain at zero for years. Quantitative easing will continue for an extended period.

Asset purchases by major central banks help reduce borrowing rates by offsetting the sharp increase in government debt issuance and help keep liquidity flowing to households, businesses and local governments. Lower interest rates provide a platform for government spending. Balance sheets have expanded even more than during the period following the global financial crisis and are likely to stay enlarged for a long time. New purchases will however slow as economies re-establish their footing.

CHART 1: CENTRAL BANK ASSETS

Source: St Louis Fed

Loose monetary policy will prompt a rise in inflation, but not for a time yet. US inflation was merely 0.4% annualised in June 2020, dragged by the shutdown shock. “We’re not even thinking about thinking about raising rates,” said Fed Chairman Jerome Powell during his June and July 2020 press conferences.

The strength of inflation will depend on how strongly economies recover and how rapidly consumer and business spending lifts and for how long central banks allow the money supply to increase so dramatically. Extraordinary monetary stimulus had limited impact on inflation in the years following the global financial crisis, but now fiscal policy is no longer an offsetting force. However much of the government spending to date is helping to prop-up activity rather than stimulate. Deflation from the plunge into recession and fall in commodity prices is likely to have concluded with general prices once again rising. Inflation is likely to rise but there will be restraints due to continued consumer and business caution related to the virus uncertainties, lower wages growth due to stubbornly high unemployment and reduced company pricing power because of discounting to lift sales. Inflation expectations measured by five-year forward interest rates have recovered strongly since lows in March 2020, but at 1.7% remains short of the 2% US Federal Reserve target.

Governments have shown a willingness to support the household sector, not choke off support too soon, and to allow fiscal deficits to rise sharply. Households and businesses most damaged by the crisis will need more help. Threat of poor performance in the November 2020 elections is likely to encourage the Republican-controlled US Senate to support additional stimulus. The European Union is introducing a EUR 750 million pandemic recovery fund which provides low cost funding for member-state plans. Japan’s supplementary budget in June provides JPY 32 trillion for small business and strengthening of the medical system. China is also providing stimulus through increased debt formation.

Income replacement measures have been generous, so savings have increased which should lift spending in the future and help offset the drag from sustained unemployment in sectors most impacted by social distancing.

Activity levels remain well below pre-virus levels. However, several measures have shown rapid improvement. United States employment data along with retail sales and industrial activity measured by purchase managers indices (PMI) in the US, Europe and China gained strongly through May and June.

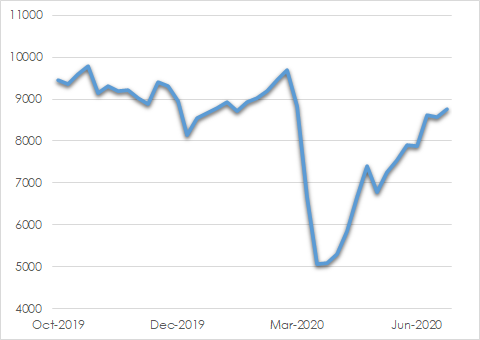

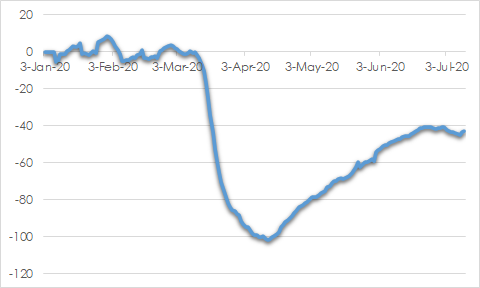

US gasoline usage is now down just 10% from February 2020 levels after being around 40% lower during April. The Dallas Fed Mobility Index reflects activity slowly returning to normal despite varying degrees across states of success in containing the virus. New cases are rising in some states while falling in others. Freight has begun to lift, as seen in the Cass Freight Index which measures volume of goods shipped across the US by truck, rail, air or ship.

CHART 2: US GASOLINE PRODUCT SUPPLIED (bbl per day 000s)

Source: EIA

CHART 3: DALLAS FED US MOBILITY INDEX

Source: Dallas Fed

Consumption is likely to continue to recover as economies reopen. Individuals have shown a willingness to rapidly resume activities like attending restaurants and hotels that they were not able to do during shutdown. The increased proportion of younger demographics contracting the virus reflects behavioural changes shielding the more vulnerable while most others resume activity.

The proportion of overall activity comprising consumer spending and services may shrink in the new economy, but this could in part be compensated by a rise in technology, health care and construction.

The pandemic is accelerating various longer-term trends. Even lower for longer interest rates prompts rising debt levels and exacerbated wealth inequality as asset prices rise. Yield starvation encourages global investors to hunt for higher yielding assets and take on more risk than they possibly should.

De-globalisation reflects surging nationalism and trade wars. Coordination between countries is reduced by the decline in labour mobility due to fears of infection and government restrictions. US and China’s increasing rivalry is fuelling geopolitical tensions. Disputes relating to trade and intellectual property rights have escalated into more significant issues like technological dominance and international security.

Countries are being encouraged to build greater economic independence by accessing additional sources of supply or creating capacity of their own. Manufacture is likely to become more localised which will enhance sustainability at the expense of efficiency. This constraint on corporate profit margins could be offset by the increased impetus to invest in automation and productivity once business confidence rises from current low levels. This has positive implications for robotics, software and e-commerce.

Increased hours working from home is accelerating digitisation of the economy and shifting the location of demand for food and drink to suburban supermarkets from centrally located restaurants and bars. Sectors benefiting from behavioural changes include digital entertainment, retail and healthcare providers, domestic tourism and supermarkets.

Investment Strategy

Equity markets rebounded strongly since March 2020 as sentiment toward risk assets improved considerably. Our portfolio values held up better than most while markets tumbled in the first quarter. Our preference for high quality assets and asset purchases at discounted prices assisted strong positive returns in the second quarter.

As always, we are focused on building long-term, diversified portfolios that deal with uncertainty and do not necessarily rely on either gloomy or optimistic market conditions.

Eventual recovery from current disasters and the likelihood of persistently low interest rates and government support provide a positive backdrop for risk assets for patient investors. Most of our equity market checklist factors point to a neutral if not positive stance toward the asset class.

However less value in now available across markets so we would prefer to wait for pullbacks in prices before adding to exposures. Loose monetary conditions and generous fiscal actions are assisting economies across the valley to recovery. This has encouraged investors to chase yields so government bond yields are now depressed and credit spreads tight. The highly uncertain climate is likely to prompt periods of renewed investor risk aversion, providing opportunities for us to snap up bargains. We have additional cash on hand which provides options, though some dry powder has been used through our Australian equity purchases since mid-March 2020.

Bond yields are likely to drift higher as the economy continues to recover in the second half of this year. We maintain our underweighting to fixed interest. More confidence in the outlook and an increasing supply of longer-term government bonds with an increased budget deficit, all while the central bank maintains extremely low interest rates out to three years, should pressure bond yields higher, steepening the yield curve.

We send our sympathies to everyone directly or indirectly impacted by the coronavirus and our appreciation to the health care professionals and service providers who are expertly providing care to those in need.

Andrew Doherty. AssureInvest

This article is provided as general information only and should not be construed as personal financial advice.

FREE Special Report: How to Jump ahead of competitors and add more value for clients

Learn how you can boost profits while enhancing customer outcomes.