Global activity continues a path of slower economic growth with inflation and interest rates settling above average levels for the decade prior to the pandemic. Unusually high levels of geopolitical and political volatility are unlikely to alter this progression.

Consumption will be assisted by high levels of employment, rising wages, lower borrowing rates and rising asset prices that buoy higher income groups. Corporates earnings, especially in the US, are being helped by solid demand and investment in innovation. Central banks have plenty of ammunition to combat surprise falls in activity despite rate cuts already made since late last year.

Strong services activity is positive for job creation due to high labour intensity. By contrast, manufacturing has been weak, particularly in Germany and France where exports have been dragged by weak Chinese consumption and high energy costs. Meanwhile, the stronger dollar is constraining US manufacturing competitiveness. However, production might lift this year helped by lower interest rates, improved consumer confidence and increasing demand for housing materials and goods.

US growth is slowing as job growth declines, but it is still likely to perform better than other key regional economies in the next two years helped by productivity gains and strong domestic and international investment. The range of possible growth and policy outcomes is wide, both through downside risks and to the upside through innovations in artificial intelligence, robotics and medicine.

Trump policies may broadly be considered “pro-growth” but activity is likely to be slower and unemployment and inflation somewhat higher, at least in the short term. Monetary policy could be held in restrictive territory for longer than otherwise. These uncertainties may make companies and individuals more cautious about planning for the future.

Contrastingly, international growth and inflation are likely to be somewhat softer and so interest rate cuts may be more substantial. China is struggling to counter the adverse forces of an aging population, property weakness and large debt balances. European growth should maintain its anaemic pace given delayed impacts of tighter monetary policy, political discontent, trade conflict obstacles, relatively tight regulation and external energy reliance. Meanwhile, activity in Japan and Australia should increase through stronger consumption helped by tax cuts and government spending.

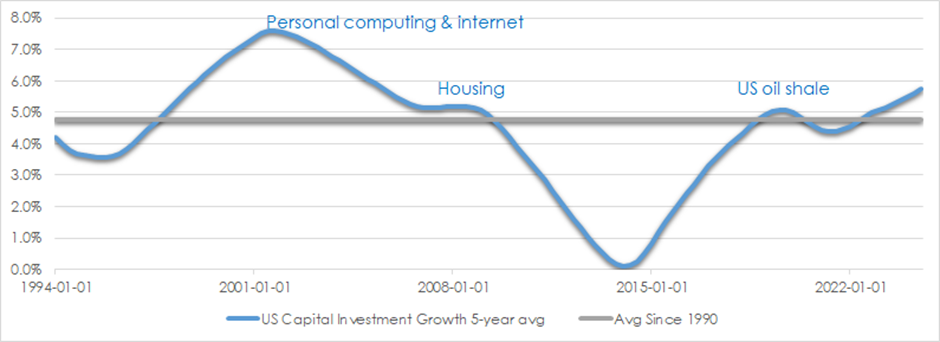

The rise in US business investment adds to the capacity of the economy and bodes well for productivity. Most significant is investment in digital and data capacity along with increased production of electronic vehicles, batteries, renewable energy and semiconductors. The wish to fortify post-Covid supply chains by reshoring manufacture are also substantial. Capital expenditure as a proportion of GDP is now at its highest level since 2007. Information processing investment jumped during the pandemic to support work from home and should remain strong for several years as businesses incorporate artificial intelligence and robotics technologies into their processes. There is scope for further expansion in business investment which remains relatively modest compared to previous peaks such as the personal computing and internet boom in the late 1990s/2000, the US housing build out up to 2007 and oil shale expansion in 2016-2018.

CHART 1: US CAPEX 5YR AVG GROWTH

Source: FRED, AssureInvest

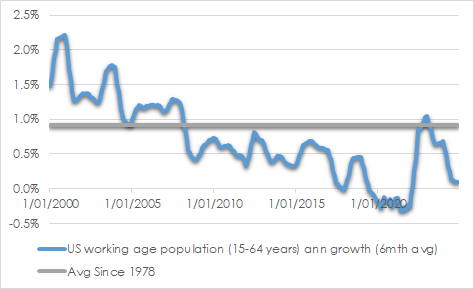

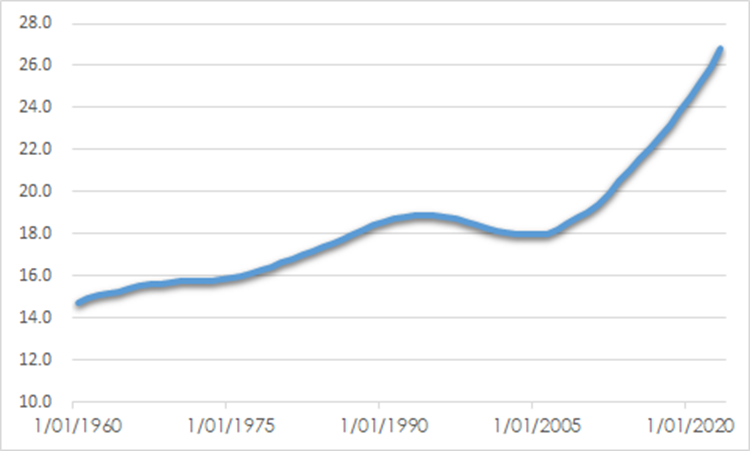

The longer-term growth of the US economy is being slowed by falling population growth and the aging workforce. There are 209 million US workers in the 15-54 working age group which is growing annually by only 0.1%, well below the average 0.9% since 1978. The population aged 65 and above is now 26.8% of this working age group compared with just 16.3% in 1978. Falling birth rates and longer life expectancy mean a smaller number of workers must produce enough goods and services to satisfy a growing number of retired buyers. Unemployment would be marginally lower and prices higher as a result.

CHART 2: US WORKING AGE POPULATION GROWTH

Source: FRED, AssureInvest

CHART 3: US AGE DEPENDENCY RATIO: OLDER DEPENDENTS TO WORKING-AGE POPULATION

Source: FRED, AssureInvest

Monetary policy restrictive in the US while loosening elsewhere

Inflation continues to decline as pandemic-era supply chain complications continue to resolve and the pace of economic expansion reduces. Underlying measures of inflation should finally fall to central target levels by the start of next year, if not before. However tight labour markets continue to slow the decline in wages and therefore services inflation. There is a reasonable chance of a moderate reacceleration in price appreciation through 2026 which may be assisted by Trump’s barriers to trade and immigration.

Central banks may be more cautious about cutting interest rates in the near term until the impacts of US administration policy changes become clearer. US monetary policy remains restrictive despite the 100 basis points in cuts so far from the peak. The US Federal Reserve may be restrained from reducing rates more than one or two times this year despite a modest rise in unemployment. Bank lending standards are slightly less restrictive but credit expansion remains weak despite some improvement. New mortgage rates have increased again recently to near 7.0% which is hampering the housing recovery.

Other central banks may be inclined to cut rates more aggressively, particularly in the face of more challenging trade environments. Given weak growth and declining inflation, the European Central Bank will be encouraged to cut rates by 100-150 basis points following the 100 basis points in reductions already made in the second half of last year. The Bank of Japan is likely to continue a very slow and measured unwinding of extraordinary monetary stimulus given wariness about snuffing out the recovery. Short term rates are still just 0.50% following two hikes last year and one in January. Further hikes to 1.0% are possible this year.

Investment strategy

The case for diversification is strong. Investors should be wary of unexpected events such as a stronger recovery phase that reaccelerates US inflation and helps lift commodity prices and bond yields. Alternatively, Trump tariffs may prompt a sharper than expected economic contraction. Overexuberance in some high-tech and cryptocurrency exposures also warrant attention.

Underweighting US equities remains appropriate given high valuations while earnings slow as job growth stalls and stubborn inflation remains. Increased concentrations in the stocks that have performed the strongest in the last decade add to risks. There is a chance the mega-cap tech stocks could be found out for overspending on data centres and other artificial intelligence infrastructure.

European equities offer far better value, despite political uncertainties, given overly bearish investor sentiment and possible upside surprises as consumers benefit from income gains and much sharper interest rate cuts than might have been expected several months ago.

We have higher cash balances within our Australian equities portfolio having allowed dividends to build. We continue to press for better-valued, higher-quality situations. The Australian economy’s large exposure to a negative outcome from rising US/China tensions are balanced by the likelihood of added Chinese government stimulus and the possibility of greater than anticipated Reserve Bank rate cuts.

FREE Special Report: How to Jump ahead of competitors and add more value for clients

Learn how you can boost profits while enhancing customer outcomes.