There is little doubt that political changes and their implications for economies and markets will be at the forefront of investors’ minds again this year. Some changes will help markets, others hinder.

Volatility in asset prices is likely to be higher than experienced in the recent past. Risks are heightened through the prospects for tighter monetary policy, strained or altered trade and geopolitical relations and the prospect that new measures in Washington might disappoint market expectations.

The uncertainty we are experiencing helps us concentrate on what matters to us most — for investment portfolios this is capital security and robust returns over time. Through it all, the environment is still reasonably favourable for equities due to continuing global economic growth, low inflation, expansionary monetary policy and the shift to greater fiscal support.

Share valuations are reasonably full however so we have neutral weighting to the equities asset class. US equities are stretched and we see better value in other key regional markets. Bonds are likely to underperform cash as inflation moderately rises over time.

In this time of extraordinary change, we publish here our top six investment themes for investors in 2017 and beyond.

1. Ongoing, maturing equities bull market

The equity bull market that commenced in 2009 has further to go despite the rise in prices in recent months. Anchored inflation, accommodative monetary policy and the shift toward an easier fiscal stance provides a supportive environment for equities. Any near-term sell off in share prices would be an opportunity to add to positions.

Continued economic expansion which supports rising corporate earnings is central to a constructive view on equities. In fact, we expect slightly stronger global growth this year despite the uncertainties. GDP growth will improve in the US and Europe while in Japan the weak but positive pace will be maintained. China should maintain its position as the globe’s fastest growing major economy, but the pace is likely to ease somewhat.

Recessions typically follow periods of overheating and aggressive monetary tightening however and it would not be until later next year that these conditions might prevail. Sharp downturns in Europe or China that might halt global growth are low probability outcomes, at least for this year.

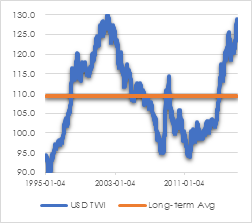

Counterbalancing the supportive factors, the US dollar is likely to appreciate further, but probably not as steeply as it has in the last two years. This will help to tighten financial conditions, making the environment more difficult for US dollar indebted emerging economies and weigh somewhat on multinational earnings.

CHART 1: USD TRADE WEIGHTED INDEX

Source: St Louis Fed, AssureInvest

Equity prices are by no means cheap however, and the smaller margin of safety necessitates more conservative portfolio settings. Returns are likely to be positive, but lower than typical. The US equity market in particular appears stretched to us offering little leeway for negative surprises, not the least of which is the potential for US policy to fall short of expectations. Better value is available in other regions.

2. Inflation to surprise on the upside

Inflation is likely to rise more sharply than many investors expect despite being anchored at relatively low levels compared to historical averages by a range of longer-term forces.

Deflationary forces are dissipating following the part-rebound in commodity prices and the slow using up of excess capacity as employment rises through the western world. Developed economy growth is improving slightly while several emerging economies are making their way out of recession. The shift toward looser fiscal policy is likely to have more positive than negative implications for growth and inflation.

The US is the main driver of rising inflation expectations. Inflation expectations have risen in recent months as indicated by market interest rate data.

CHART 2: US 5-YEAR, 5-YEAR FORWARD INFLATION EXPECTATION RATE

Source: St Louis Fed

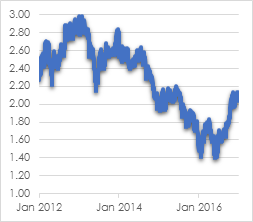

The yield curve has steepened in recent months, indicating that the market is expecting more positive economic growth and inflation. A downward-sloping yield curve would indicate that investors believe a recession is likely, inflation is falling and there is more need for lower official interest rates.

CHART 3: US YIELD CURVE RISING

Source: St Louis Fed, AssureInvest

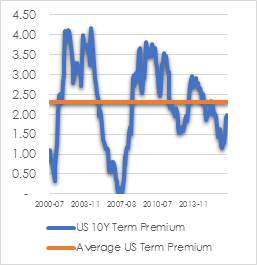

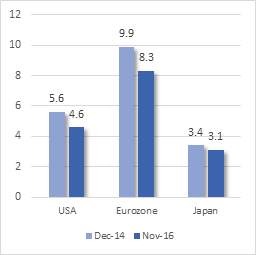

Employment growth is the critical element in inflation forecasts through the eventual positive impetus for wage rises. Unemployment continues to decline across global economies, having dropped significantly since 2008. Robust wages growth is established in the US where average hourly earnings are now growing by 2.9%. More significant fiscal action could support upward pressure on wages. Infrastructure projects in the US are likely to commence In 2018 in a tighter labour market. Elsewhere, wages growth is being suppressed by continuing high unemployment in Europe and the greater share of the new jobs being created in less productive services roles in Japan.

CHART 4: FALLING UNEMPLOYMENT

Source: Govt data agencies

Inflation could surprise on the upside if commodity prices or US wages were to jump higher, fiscal expansion was more aggressive than expected or trade wars and anti-immigration policies disrupt markets. Inflation could surprise on the downside if capacity surpluses proved resilient, oil supply increased meaningfully or a sharply higher US dollar caused a downturn in emerging markets and a slowing of US activity.

Too many investors remain fixated on a deflationary trend that is now dissipating. While maintaining our bias to high quality, over the past year we have repositioned portfolios to benefit from the modest rise in inflation. Our equity portfolios have more of a tilt toward cyclical companies and less to high yield, low-growth businesses like utilities, telecommunications and real-estate investment trusts. Bond yields have been rising since the middle of 2016 and there is more to go. Clients benefited from our past maximum underweight exposure to government bonds. Following the steep rise in yields post the US presidential election in November, we increased our weighting to the asset class but maintained an underweight exposure.

3. Loosening fiscal policy

The trend to increased fiscal support, or at least less fiscal austerity, stems from evidence that monetary policy is becoming less effective, a rise in populist politics and the prevalence of low interest rates which reduces the costs of funding policy actions. Being politically contrived, there is a risk that some of the measures will have less than optimal economic outcomes but the overall impact on activity is likely to be rather more positive than negative.

“Tax cuts, fiscal spending and regulatory reform… are likely to add 0.5% per annum to US GDP from 2018”

Fiscal stimulus in the US is likely to be significant in the next few years given Republican control of the three arms of US government. Tax cuts, fiscal spending and regulatory reform, offset by the likely rise in currency, interest rates and inflation, are likely to add 0.5% per annum to US GDP from 2018. The changes will take time to implement, so there should be little impact in 2017.

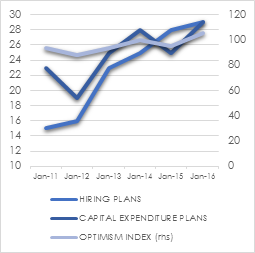

Already there has been a positive flow-on effect to consumer and small business confidence. NFIB Small Business Optimism came in at 105.8 in December 2016, up from 98.4 in November. Small business hiring intentions are also positive. There is also a rise in small business capital spending intentions which could add to sustainable growth and help to lift productivity.

CHART 5: US SMALL BUSINESS OPTIMISM

Source: NFIB

Fiscal expansion in the US is likely to encourage other governments to follow similar paths. A number will be constrained by existing high debt levels and weak fiscal positions however. Europe is likely to loosen fiscal policy ahead of key elections this year and increasing influence of populist parties like the French National Front that is calling for lower taxes among other measures.

Japan is likely to push through additional stimulus to maintain momentum following its budgetary measures in the second half of 2016.

4. Monetary policy less accommodative

Monetary policy has become less effective as global rates approached and passed through zero. Modestly rising global growth and inflation in tandem with a shift toward easier fiscal policy allows international activity to be less reliant on monetary accommodation.

The US Federal Reserve is likely to continue the gradual normalising of interest rates it has pursued over the last two years though the pace will quicken through 2017. Two or three rate hikes are likely.

“The need for extraordinary monetary policy measures is declining as deflationary forces diminish, the negative effects of ultra-low interest rates become clearer and fiscal policy becomes more stimulatory”

Maintenance of financial market stability will continue to factor on rates decisions particularly while US policy is divergent from Europe and Japan. Higher US rates could prompt rapid US dollar appreciation which would weigh on the ability of emerging economies to repay US dollar debts. The US Federal Reserve could well hold back on hikes ahead of European events this year, especially the April/May French presidential election. An unlikely victory by the National Front’s Marine Le Pen could help to initiate a process of removing France from the Eurozone. Rising US wages and inflation momentum would require at catch up on rate rises from mid-year.

The need for extraordinary monetary policy measures is declining as deflationary forces diminish, the negative effects of ultra-low interest rates become clearer and fiscal policy becomes more stimulatory. Europe is likely to maintain negative short term interest rates while tapering and eventually ceasing its bond purchase program potentially by the end of the year.

The Bank of Japan’s shift in September 2017 to a policy of controlling the yield curve was an admission that forever cutting short term rates into negative territory would not achieve the stimulatory outcomes intended. The new measures target a modestly positive yield curve through negative short term rates and 0% 10-year bond yields. This ensures low interest rates to assist the funding of fiscal measures while supporting bank profitability through a steeper yield curve.

5. Rising tide of populism

A growing anti-establishment and anti-globalisation sentiment is reflected in the 2016 Trump presidential election and British decision to leave the European Union. Politics will prompt greater than usual investor attention again this year. Key events include Dutch, French and German elections. Early elections in the United Kingdom and Italy are also possible.

Local grievances and the popularity of anti-establishment parties have been gaining momentum as the ability of governments and central banks to alter individuals’ financial lives for the better has been increasingly questioned. Globalisation has been blamed for the slow economic growth and increased inequality since the global financial crisis.

Trump’s US presidential election introduces potentially significant changes to US foreign, security and defence policy over which the US president has significant influence. Key alliances such as NATO and US-Japan could shift. US-China relations already appear more volatile after a long period of stability.

The anti-globalisation wave might slow trade but a collapse is unlikely as the cost and quality benefits of global sourcing for companies and consumers will remain high. The extensive real-life business experience of the members of the Trump administration indicate that a pragmatic approach will be taken, thereby reducing the likelihood of trade wars per se.

The march of globalisation will continue but for a time politics could create a more inward-looking stance with looser fiscal policy to boost jobs and equality. In Europe, populist parties may not win outright in any of the key elections this year but their anti-European and anti-immigration policies may gain greater influence.

6. Emerging market sustainability

Emerging markets have been an important source of recent global growth. The impact of changed internal and external economic forces on this segment have important implications for the investment outlook. Growth may be more challenged under the evolving landscape.

Improved advanced economy growth and the shift toward looser fiscal policy has positive implications for commodities and other emerging market product demand and pricing. However, risks emanating from any rapid rise in US dollar and interest rates could prompt further capital outflows and make US dollar debt harder to support. Countries more reliant on trade will be most impacted by any anti-globalisation policies.

China, the world’s largest emerging economy and second largest overall, is likely to encourage further fixed-asset investment to maintain targeted growth levels. The strong rise in retail and services spending is testament to the impressive shift toward consumption from investment-led growth. The fact that credit is being allowed to expand so rapidly is cause for concern despite the high savings rate and government control of much of the economy. There will need to be a reckoning at some point, at least via slower longer-term growth. Maintaining positive momentum is the Government’s priority for now.

China’s foreign currency reserves have declined for the past six months and there is likely to be continuing capital outflow while there is downward pressure on the currency. Recently tightened capital controls will slow the flow somewhat and make it more likely that the process is orderly, which is the most important thing. The prospects of the Government allowing the yuan to float freely or with a wider trading band have increased but still unlikely in the near-term.

A version of this article first appeared in SMSF Adviser Magazine.

Contact Us

Let us demonstrate how we can deliver outstanding outcomes for you.

p +61 2 8094 8410

e [email protected]

About AssureInvest

AssureInvest is your trusted professional investment partner. We offer a holistic and successful investment approach and carefully tailored solutions for individual needs, as well as cost saving innovations, integrity at the highest level and attentive customer service.

Our advisor clients are empowered to boost their profits and deliver better investment outcomes, benefiting their clients and the broader community.

Our disciplined and long term focus provides a critical framework for assessing new value-adding opportunities, preserving capital, generating superior returns and implementing at low cost.

Copyright

Copyright © 2017 AssureInvest Pty Ltd ABN 55 636 036 188 (AssureInvest). All rights reserved. No part of this publication may be reproduced or distributed in any form without prior consent in writing from AssureInvest.

Disclaimer

AssureInvest has taken all care in preparing this presentation and the data, information and research commentary within it (together referred to as the ‘publication’) but to the extent that the publication is based on information received from other parties no liability is accepted by AssureInvest for errors contained in the publication or omissions from the publication. AssureInvest gives neither guarantee nor warranty nor makes any representation as to the correctness or completeness of the publication. AssureInvest bases its data, information and research commentary on information disclosed to it by other parties. Past performance is no guarantee of future performance. This publication is intended for Australian residents only.

General Advice Warning

The information contained within this publication is of a general nature only. No information contained in the publication constitutes the provision of securities advice. AssureInvest warns that: (a) in preparing the publication, AssureInvest did not take into account the particular goals and objectives, anticipated resources, current situation or attitudes of any particular person; and (b) before making any investment decisions on the basis of that publication, any investor or prospective investor needs to consider, with or without the assistance of a securities adviser, whether the information contained within the publication is appropriate in light of the particular goals and objectives, anticipated resources, current situation or attitudes of the investor or prospective investor. If the information contained in this document relates to the possible purchase of a financial product, the client should consider the relevant product disclosure statement (PDS) before making any decision.

Disclosure

AssureInvest has no debt or equity relationship with any funds management or financial advisory group. AssureInvest may have an interest in the securities referred to in the publication in that AssureInvest and/or its staff may hold or intend to hold deposits, shares, units or other rights in respect of such products and from time to time AssureInvest may provide some of the investment product providers mentioned in the publication with research, consulting and other services for a fee.

AssureInvest Pty Ltd

ABN 55 636 036 188 AFSL number 47897

FREE Special Report: How to Jump ahead of competitors and add more value for clients

Learn how you can boost profits while enhancing customer outcomes.