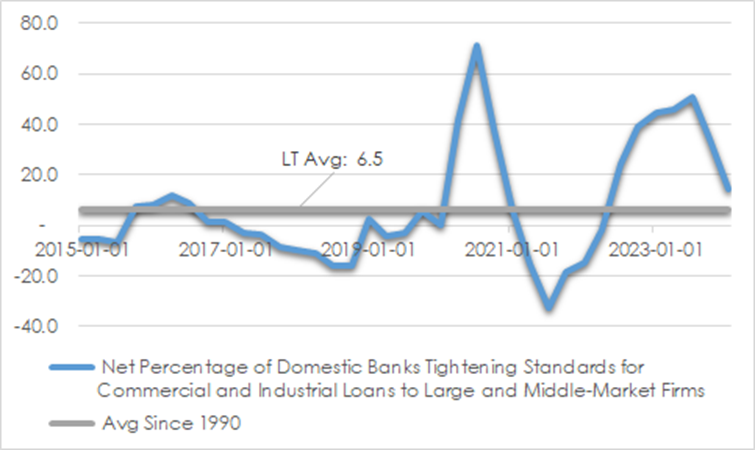

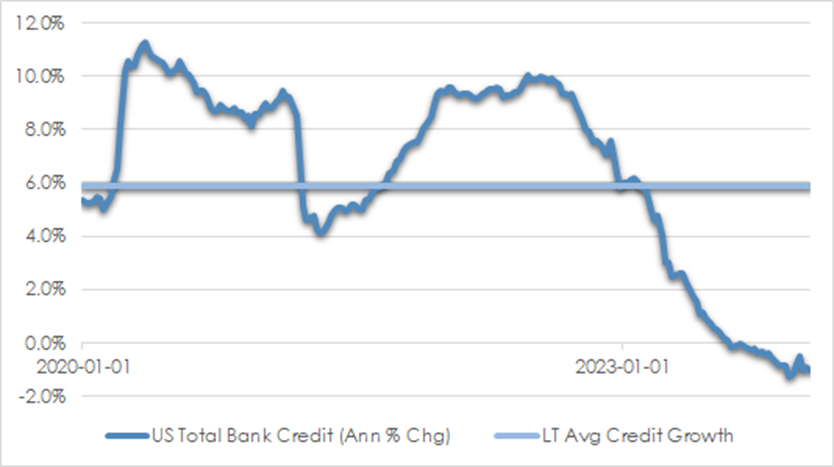

Global growth is slowing as the rebound from pandemic disruptions fades. The US economy was surprisingly strong through 2023, helped by fiscal support and consumers bolstered by plentiful work opportunities, high pandemic savings and the positive wealth effect from higher house prices. Now the most indebted sectors are being bitten by interest rates kept high to deal with stubborn inflation as debt is rolled at higher rates. US bank credit has been in decline since late last year, weighed by tighter lending standards.

CHART 1: US LENDING STANDARDS

Source: St Louis Fed, AssureInvest

CHART 2: US BANK CREDIT GROWTH

Source: St Louis Fed, AssureInvest

Consumption will soften as the jobs market slows, savings are exhausted and the post-pandemic surge in services like travel, dining and other experiences subsides. Business investment is likely to be constrained by the more challenging environment. Commercial real-estate is particularly pressured by higher loan expenses and structural shifts. Activity in Europe is already stagnant and a mid-year US recession is still probable.

However, relatively solid household and corporate balance sheets indicate the slowdown will be modest and short-lived. Rate cuts in the second half should help activity start improving by end of the year. Manufacturing has been depressed since early 2023 but should begin improving as consumer sentiment and spending power revive and businesses end their inventory drawdown phase.

Services inflation taking time to soften

Inflation is easing but it may take longer than some investors expect to return to targeted levels. Headline inflation has declined significantly in the last eighteen months, helped by softer goods demand and freeing up of supply chains clogged during the pandemic. Core inflation has softened significantly less given its higher services element. Services prices are far more reliant on employment markets which tend to take longer to shift. Unemployment remains low, so wages keep accelerating.

Softer services demand should weigh on job creation, but this will take time. Rents are also still rising quickly given the housing undersupply and construction slowdown which may take more than a year or so to resolve.

US core inflation is still 3.5% and unlikely to fade to the 2% target until late next year. Even then, maintaining inflation around that level may be challenging given the likely reacceleration in industrial activity. Structural forces appear to be adding to inflationary pressures, such as the energy transition and part reversal of globalisation, although artificial intelligence and aging western populations may act against this. Commodity price spikes responding to geopolitical and weather shocks could add volatility to the medium-term inflation outlook.

Monetary policy pivot this year

Rates have peaked in most key economies. Several central banks such as the US Federal Reserve and European Central Bank are likely to start easing policy from the middle of year. Australia is likely to keep rates at higher levels because it has been slow to move to a restrictive stance while population growth, tax cuts and a reviving China add to activity. Japanese monetary policy is likely to remain expansionary though there may be further moves away from extraordinary stimulus through modestly higher rates later this year.

The US Federal Reserve may cut rates by 1% in the second half, the quantum being determined by the stubbornness of underlying inflation and the increasing chance of recession while policy is restrictive. While growth maintains a positive trajectory, it will wait for clearer signs that the inflation threat has passed before starting to cut rates, such as through a fall in job creation.

The Fed will not wait until core inflation falls below 2% before cutting rates. It will be concerned about troubled US commercial real estate loans and the constraints on bank profits when long term interest rates are below short term as they are now.

A return to low rates as seen before the pandemic is unlikely given fear of repeating mistakes of the 1970s where rates were cut before inflation was destroyed. The Fed will also be keen to avoid cutting rates too quickly before having to undo those changes. Structural forces supporting inflation such as globalisation and the energy transition mean the low point in rates this cycle may be meaningfully higher than in the decade leading up to the pandemic.

Investment strategy

The pivot from tightening to easing monetary settings among major central banks this year is having a critical impact on global activity and financial market pricing.

We have a constructive view on equities, constrained somewhat by the lack of outright value in some areas. Consensus earnings forecasts may prove ambitious as weakening pricing power and volumes weigh on profit margins. However the economic downturn is likely to be relatively short-lived because individual and business balance sheets are generally in good shape and central banks will be ready to ease policy quickly should conditions soften more than currently projected.

Our regional equity allocations are tilted to an overweighting to Europe where valuations understate prospects for very mild expansion in the next several years supported by lower inflation and interest rates and improved exported goods demand. We have neutral exposure to Australia and Japan and underweight the United States which is more expensive and also exposed to a greater downshift in activity than other areas. US equity valuations have lifted more than other regions in response to excitement around the potential for the technology sector to be revolutionised by artificial intelligence and this weighs on prospective returns.

Our direct equity selections focus on high-quality companies with structural growth less impacted by the economic challenges and strong cash flows that support dividends. Of particular interest are entities with pricing power able to offset subsiding but still elevated business costs through powerful brands or customers who have trouble switching to alternate providers.

We see opportunities among firms benefiting from growing and aging populations such as in healthcare and supermarket retailing. There is also attraction in some post-pandemic losers that are gradually resolving various demand, supply and operational disruptions.

Monetary policy is likely to be the source of financial market volatility this year. The market may be dissatisfied with the timing and quantum of interest rate cuts. Rising bond yields may then destabilise asset prices later in the year as the market progressively factors in an economic boost from less restrictive policy.

We remain underweight fixed interest with shorter duration than benchmark along with only modest weighting to mainly higher-quality credit securities. Australian government bonds have rallied in recent weeks on the hope that falling inflation and softer activity will encourage the Reserve Bank to cut cash rates soon. More than two cuts this year are priced into traded bond values. We expect the market to be disappointed.

Andrew Doherty. AssureInvest

The Information constitutes only general advice to wholesale investors. In preparing this document, AssureInvest did not take into account your particular goals and objectives, anticipated resources, current situation or attitudes. Before making any investment decisions you should review the product disclosure statement of the relevant product and consult a securities adviser. Past performance is no guarantee of future performance. This document is not intended for publication outside of Australia.

FREE Special Report: How to Jump ahead of competitors and add more value for clients

Learn how you can boost profits while enhancing customer outcomes.