A number of significant threats cloud the investment outlook. Bouts of heightened volatility will continue to be part of the investing landscape. Here we discuss the five biggest risks in the forefront of investors’ minds today, including the potential for global recession, sharp decline in Chinese activity and the precariously high level of asset prices.

We discuss how investors should position their portfolios to best manage the conditions.

Despite the uncertainties, the mild-growth, low-inflation environment is conducive to positive returns from share investments. Equities should continue to lead portfolio returns given fairly weak competition from other asset classes.

However, investors need to be on guard for a rapid sell-off in asset prices at any time due to intensified concern over any of the issues discussed in this article. Given the circumstances, investors would be wise have additional cash on hand to be ready to take advantage of sporadic market opportunities to add to high-quality assets at cheaper prices.

1. Risk of Global Recession

Central to the ability to generate positive returns from growth assets like shares and property is the avoidance of a deep global recession.

Risk of a global economic downturn is higher than usual particularly while deflationary forces and soft demand weigh on the outlook. However, we expect expansion to continue, at least for the next two years. Key growth supports are the ongoing United States (US) recovery, China expansion and unconvincing but persistent improvement in Europe.

The immediate climate is far more positive than it was at the start of this year. The weaker US dollar and likely bottoming in oil prices has eased pressure on US exporters, resources producers and emerging market economies with high US dollar debt balances.

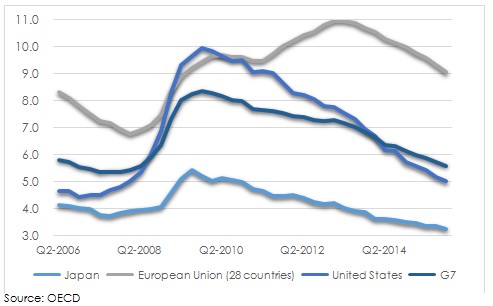

Consumption remains the key driver of developed economies. Continued progress toward full employment should support modest wage growth and spending. Unemployment is now 5.6% in G7 countries, the world’s seven most powerful industrialised countries. This is the lowest since 2007. Savings rates are high in the US so a shift to higher spending patterns could be swift.

“Continued progress toward full employment should support modest wage growth and spending”

However, spending will be restrained for some time by a sharp focus on reducing debt, continuing high unemployment in parts of Europe and constrained lending by banks while they build their capital bases. Consumer sentiment is further restrained by low job security and the high proportion of workers in part-time roles rather than their full-time preference.

CHART 1: DEVELOPED MARKET UNEMPLOYMENT

While we expect the global economy to maintain a positive growth trajectory in the near term, its pace will be particularly slow. The climate for a sharper rise in corporate revenues is not present as modest growth prospects provide little impetus for companies to invest in new projects by reigniting capital investment campaigns. A more uncertain climate for companies is created by the high degree of technological disruption of industries, weakened ability to raise prices and significant changes to regulatory environments. In response, there is less incentive to cut the relatively high proportion of earnings used to pay dividends or buy back shares. Mergers and acquisitions are increasingly popular given the scant organic growth opportunities. These tend to weigh on economic growth as they typically lead to cuts in the workforce and only rarely result in a lift in productivity.

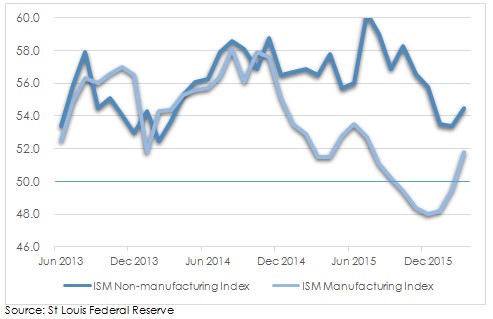

United States – The world’s largest economy remains in a mild upswing, though this cycle is maturing. We anticipate gross domestic product (GDP) growth around 2% per annum in the next few years driven largely by service rather than manufacturing activity. Recession risks are not high, but will increase as interest rates rise and the US dollar resumes its upward trend.

The recent slump in industrial activity may be over. US manufacturing is growing again after a period of weakness. Share market analysts have been busy cutting 2016 earnings forecasts on weaker global demand. The bounce in oil prices and a weaker US dollar, combined with the base effects of comparison to a weak 2015, may result in earnings actually surprising on the upside. This would provide a fillip to share prices in the short term.

CHART 2: US MANUFACTURING AND SERVICES

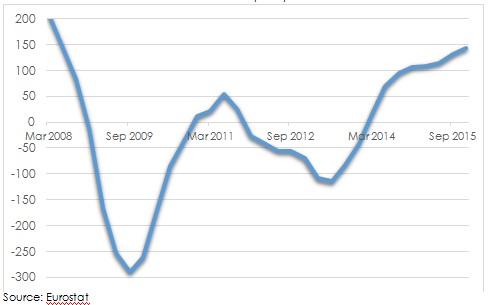

Europe – Extremely mild growth and inflation is set to persist for some time in Europe. Ultra-low interest rates are giving governments time to restructure their finances and reduce debt. Consumption is being assisted by lower energy costs, rising lending and employment growth which at 140,000 per month is the highest rate since 2008. Unemployment across Europe continues to decline but rates are highly divergent across countries: German unemployment is 4.3% while Spain is 20.4%. Workforce participation should rise as more people see opportunities for employment, but high levels of remaining slack mean wage inflation is very slight.

CHART 3: EMPLOYMENT GROWTH PER MONTH (‘000s)

2. China Hard Landing

Representing over 16% of global GDP, a sharp decline in China would have major economic implications globally.

China is likely to be the fastest growing major economy over the next five years despite its moderating pace and occasional periods of disappointment. Downside risks remain but recent economic data points to greater stability than was seen late last year and early this year.

China has loosened monetary policy and brought a number of infrastructure projects forward to counter a slowdown in industrial activity and allow time for structural reforms to have an impact.

“The rise in [Chinese] house prices and debt does refuel concerns over potential excesses”

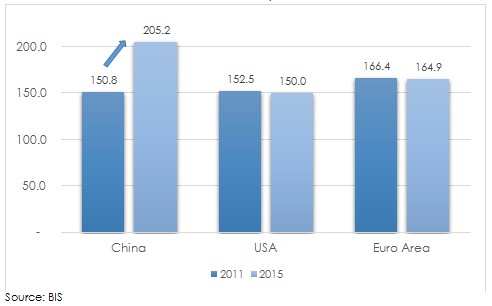

The rise in house prices and debt does refuel concerns over potential excesses. Private debt as percentage of GDP rose from 150% in 2011 to 205% in 2015. This measure is much higher than US (150%) and Europe (165%). However household debt is probably not as high as it should be. Household debt to GDP is 38% in China, compared with 80% in the US, 85% in the United Kingdom and over 100% in Australia.

CHART 4: PRIVATE NON-FINANCIAL SECTOR DEBT/GDP %

The Chinese Government does have room for further monetary stimulus as interest rates and bank reserve requirement ratios remain relatively high. Implicit Government support means that there are unlikely to be significant bank failures that would lead to a pronounced financial crisis. However, the process of corporate and local government deleveraging and managing bad loans is likely to weigh on potential economic growth for some time.

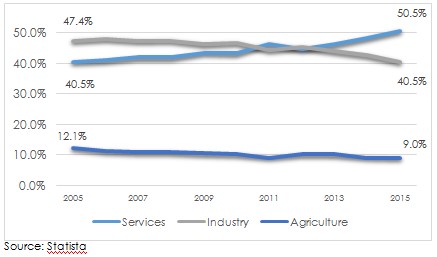

Further volatility in economic data should be expected as China’s transition continues. Impetus remains for a further shift toward more sustainable services-led growth. Services surpassed 50% of GDP for the first time in 2015, rising from 40% ten years earlier. Services exceeded industry (construction and manufacture) as the main source of growth in 2013. There is still a gap to the 70% of GDP that services represent in most developed markets.

Increasing urbanisation is central to the growth in consumerism which in turn is sustained by ongoing road and rail infrastructure programs. While construction has been excessive in some areas, it has created a more streamlined environment for businesses to operate. China’s growing middle class is consuming higher-value food and clothing in greater quantities and spending more on education, financial services and travel.

CHART 5: CHINA’S TRANSITIONING ECONOMY

3. US Rate Rises Could Surprise On the Upside

The US Federal Reserve has taken more of a market-friendly approach since earlier this year, but that is unlikely to continue indefinitely.

We see a difference between likely US interest rate moves and market expectations. This is likely to prompt fits of market volatility for some time yet. It now seems that rates will rise twice this year, the first of which may be as soon as June or July. We expect four rate rises through 2018 as inflation rises. The market appears to be understating likely moves, pricing in only one hike this year and two next. There are likely to be disappointments.

US inflation has been rising from extremely low levels. The US Federal Reserve will probably allow inflation to drift above the 2% target at least temporarily. Personal consumption expenditure (PCE) excluding food and energy is the Federal Reserve’s favoured inflation measure. It will take PCE core inflation another five or six months to reach 2% and there may not be an interest rate move until then. Core inflation has increased to 1.6% from 1.3% in the last six months. Price rises are reasonably broadly based, including across housing rent, healthcare and clothing, offset by the secondary effects of lower oil prices and a higher US dollar both of which are part reversing.

The tightening labour market also points to further wage rises. US average hourly earnings have finally regained their long term historical growth rate of 2.2% per annum.

US interest rates are extremely low considering unemployment is 5% and inflation is increasing. A number of benefits will flow through the economy as interest rates rise, particularly via higher returns to savers. A further modest rise in the US dollar will benefit the economy through greater external buying power. A higher US dollar is a net benefit to the economy as exports represent just 15% of GDP and trade is in deficit meaning the country buys more than it sells overseas.

CHART 6: US CORE INFLATION (PCED)

4. Unpredictable Politics

Politics will have a greater than usual impact on markets this year. A rise in nationalism and protectionism could cloud the outlook.

A British vote to leave the European Union could damage the fragile recovery in Europe. We anticipate the British public will decide to remain in, but the outcome does seem closer than it did a few weeks ago. The impact of a British exit on its economy would depend on its success in arranging trade deals. There will be two years of uncertainty. Recession and low interest rates for longer would be likely. Staying in the European Union is more likely because it will allow Britain to avoid these disturbances, make use of the concessions Prime Minister Cameron has negotiated and leave its future options open.

It is hard to know what to expect from a Trump presidency. Any shifts toward protectionism and against immigration would likely weigh on growth. Trump’s rise to be the likely presidential nominee for the upcoming elections is fracturing the Republican Party. It will be difficult for Trump to win the election if he cannot reunite the party.

5. Market Valuation: Stocks Not Cheap, Bonds Even More Expensive

Of significant concern is the elevated risk of recession in the US in the next two years while equity valuations are at full levels.

Equity markets have rebounded since February on relief that the economic environment is more favourable than had been feared late last year and in the early part of this year. We are now, however, more cautious on the equities outlook given the fullness of prices.

Equity valuations have been helped by the sustained low level of interest rates in response to low inflation. Price/earnings ratios, a popular method for judging share valuations, have been pushed higher and earnings yield, their inverse, lower. The global economy needs to deliver improving growth to justify current levels.

Investors should expect lower returns over the next five years than they enjoyed in the last five. Our forecast-period expected returns for each asset class are a lot lower than long-term historic returns due to relatively full valuations and our projections for ongoing subdued economic growth and relatively low interest rates. It would be a mistake for investors to take on greater risk in chasing higher returns.

“It would be a mistake for investors to take on greater risk in chasing higher returns”

Government bonds are even more expensive than equities. Bond yields are artificially and unsustainably low due to negative interest rates across significant portions of global fixed interest markets, central bank bond-buying programs in Europe and Japan and the flight to safety due to the numerous risks discussed in this article.

We think the market is under-pricing the likely mild pickup in inflation, particularly in the US, over the next year or two. Bond yields should steadily rise as inflation reverts to target levels and official interest rates rise further in the US this year and start rising in Australia from late next year.

How to Position Portfolios

In spite of the uncertainties, the low growth and inflation environment remains conducive to positive equity returns over the medium term. Investors should have no more than a neutral weight to equities, the appropriate level dependent on each individual’s personal attributes and specific goals. Additional cash should be kept on hand to take advantage of sporadic market opportunities to add to high-quality assets at cheaper prices.

Within equities we are neutral to Australia which benefits from GDP growth above developed-world averages and healthy franked dividends. Likely further interest rate cuts should allow some weakening in the Australian dollar which will support offshore earnings. The heavy bank exposure of the index is somewhat of a concern given the likely weakening in credit quality in the next few years. Resource producers should continue to benefit from the bounce in commodity prices though there is little certainty in the sustainability of current levels.

AssureInvest is underweight US equities which is the most expensive of the major global markets. US company profit margins are likely to decline from high levels as the labour market tightens and borrowing costs rise. We are overweight Europe which is benefiting from employment growth and mild recovery in lending despite the declining benefits of extraordinary monetary stimulus.

As for company selections, investors should seek companies able to succeed despite the weak environment. We favour attractively-priced outstanding businesses with structural growth through sustainable competitive advantages and expanding industries, robust free cash flow and strong balance sheets.

“We favour attractively-priced outstanding businesses with structural growth through sustainable competitive advantages and expanding industries, robust free cash flow and strong balance sheets”

Considering the limited growth options, a greater-than-typical proportion of shareholder returns are likely to come from dividends. Businesses delivering enduring and above-average dividend growth trading at reasonable valuations are likely to outperform.

Fixed income appears exceptionally expensive so we have a far smaller weighting to this asset class than we typically would. We have additional cash instead. Investors should still retain some portion in bonds as they provide a critical risk mitigation and diversification role in long-term portfolios. They provide returns that are more certain and negatively correlated with growth assets, helping smooth portfolio returns over time.

Although Australian Government bonds are at ultra-low yields, they are attractive relative to many other government bonds globally. Five-year Australian Government bonds yield only 1.8%, well below the 25-year average of 5.9%. In comparison, yields are 1.4% in the US, 0.9% in the United Kingdom and -0.2% in Japan.

As always, patience and commitment to a tried and tested investment approach are vital.

A version of this article was first published in SMSF Adviser Magazine on 1 June 2016.

——————————————

Contact Us

Let us demonstrate how we can deliver outstanding outcomes for you.

p +61 2 8094 8410

Copyright

Copyright © 2016 AssureInvest Pty Ltd ABN 55 636 036 188 (AssureInvest). All rights reserved. No part of this publication may be reproduced or distributed in any form without prior consent in writing from AssureInvest.

Disclaimer

AssureInvest has taken all care in preparing this presentation and the data, information and research commentary within it (together referred to as the ‘publication’) but to the extent that the publication is based on information received from other parties no liability is accepted by AssureInvest for errors contained in the publication or omissions from the publication. AssureInvest gives neither guarantee nor warranty nor makes any representation as to the correctness or completeness of the publication. AssureInvest bases its data, information and research commentary on information disclosed to it by other parties. Past performance is no guarantee of future performance.

General Advice Warning

The information contained within this publication is of a general nature only. No information contained in the publication constitutes the provision of securities advice. AssureInvest warns that: (a) in preparing the publication, AssureInvest did not take into account the particular goals and objectives, anticipated resources, current situation or attitudes of any particular person; and (b) before making any investment decisions on the basis of that publication, any investor or prospective investor needs to consider, with or without the assistance of a securities adviser, whether the information contained within the publication is appropriate in light of the particular goals and objectives, anticipated resources, current situation or attitudes of the investor or prospective investor. If the information contained in this document relates to the possible purchase of a financial product, the client should consider the relevant product disclosure statement (PDS) before making any decision.

Disclosure

AssureInvest has no debt or equity relationship with any funds management or financial advisory group. AssureInvest may have an interest in the securities referred to in the publication in that AssureInvest and/or its staff may hold or intend to hold deposits, shares, units or other rights in respect of such products and from time to time AssureInvest may provide some of the investment product providers mentioned in the publication with research, consulting and other services for a fee.

AssureInvest Pty Ltd

ABN 55 636 036 188 AFSL number 478978.

FREE Special Report: How to Jump ahead of competitors and add more value for clients

Learn how you can boost profits while enhancing customer outcomes.