Global activity has been surprisingly resilient in the face of higher interest rates, post-pandemic supply disruptions and crises in Ukraine and the Middle East. A more obvious slowing should be evidenced in coming months. Restrictive monetary policy is likely to be removed at only a steady pace, and at different paces internationally.

A more supportive environment for a broadly based recovery should be in place by late next year. Less restrictive monetary policy should assist interest rate sensitive sectors and emerging economies, particularly those with strong economic fundamentals such as in Southeast Asia. Lower US interest rates reduce the cost of US dollar financing and makes assets outside the US more attractive.

United States economic growth is slowing despite being a greater beneficiary than others of investments in technologies like artificial intelligence and the reshoring of some manufacturing activities. The US Federal Reserve appears keen to keep reducing rates following its initial 50 basis points cut in September. However monetary policy is likely to still be restrictive for at least another year, and longer if labour markets do not soften much more, which would encourage the central bank to pause.

China’s growth is milder as restrained stimulus supports sluggish manufacturing and services activity while low consumer sentiment weighs on consumer spending. Europe has continued a mild expansion path overall but with differing conditions within each nation. Manufacturing-centric German economic weakness is being offset by strength in Spain and Portugal which have heavier weightings to services. Lower interest and energy costs are likely to be key supports next year.

The US election adds uncertainty around fiscal policy, tariffs, trade, inflation and growth. Even larger budget deficits would add to already hefty debt accumulation over time. Further tariff increases are likely to increase inflation pressures while detracting from growth. Geopolitical tensions also complicate the outlook. Manufacturers are likely to be further encouraged to diversify supply chains to counter changes in tariffs and other trade barriers, reducing efficiencies.

Whether a recession is brewing remains unclear. The US economy has experienced rolling downturns across various sectors in the last two years, most prominently in manufacturing, consumer goods and housing. Older and wealthier groups benefiting from higher interest rates are key to overall consumption growth. Younger and less wealthy households are pressured most by the tighter financial conditions. This group is becoming more price sensitive but reasonable savings levels and ongoing income gains are still supporting a modest rise in spending.

US unemployment has increased to 4.1% from 3.8% a year ago, though much of this relates to increased participation. Further softening in US jobs markets in the next few months is indicated by the gradual decline in openings, quit rates and hours worked. Meanwhile, the pace of immigration is likely to reduce from its post-pandemic rebound which should also detract from growth in the workforce.

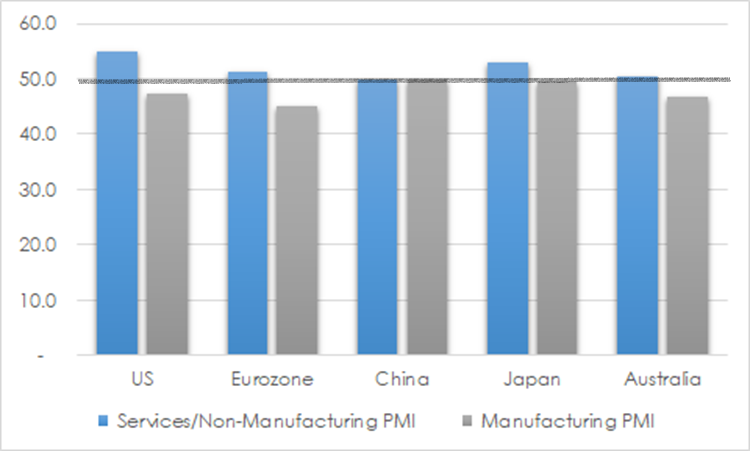

Global purchase managers indices (PMIs) point to ongoing disparity between strong services activity and manufacturing weakness. Some goods markets are still being dragged by drawdowns of inventories built high to counter post-pandemic supply chain problems. It may take until well into next year for manufacturing to more evidently strengthen, helped by lifted demand for housing-related goods like appliances and furniture as interest rates are cut and there are increased investments in artificial intelligence equipment.

CHART 1: GLOBAL PMIs

Source: ISM, Bloomberg, Caixin, Judo Bank

Price pressures continue to abate

Inflation should decline nearer to target levels in 2025 helped by softer consumer demand and moderating wages inflation. Goods inflation has already declined to pre-pandemic levels. Services inflation has been stickier but is reducing from peak readings. Australian inflation appears set to take longer to fade into the target 2-3% per annum band given relatively low interest rates, strong government sector jobs creation and lifted centralised wages rates.

There remain risks around the actual path inflation will take. Recessions could speed inflation’s decline. More likely however is that a recovery in the pace of expansion could help revive upward price pressures by the end of next year. Geopolitical tensions in the Middle East remain intense. Oil prices have reduced modestly from highs earlier this year but could fall more meaningfully as these troubles ease and allow oil supply to lift. This outcome would further help contain goods price pressures.

CHART 2: OIL VS EXPECTED INFLATION

Source: St Louis Fed, AssureInvest

Monetary policy easing to continue

Interest rates will continue to be cut in the next twelve months, but probably by less than was expected a few months ago. Average rates over the medium term are likely to be higher than experienced for much of the last decade because of higher government debt, stronger job markets and higher spending on defence and the energy transition.

US Federal Reserve easing is likely to take a slower path following the initial 50 basis points rate cut in September. Further reductions totalling 100 basis points are likely by the end of next year. With inflation heading towards target, the Fed is shifting focus towards protecting jobs and reducing downside risks to economic activity. It is keen to help the economy maintain the relatively positive environment of inflation well below peak levels and growth between 2% and 3%.

The European Central Bank (ECB) is now ahead of the Fed in cutting rates, encouraged by sluggish growth and declining inflation. The ECB started reducing rates from 4.0% in June this year. Now at 3.25%, at least another 125 basis points of cuts are likely before the end of 2025. Japan’s inflation expectations have finally lifted above 2% supported by higher wages. Gradual increases in interest rates from extremely low levels are likely to continue.

Investment strategy

Full valuations and slowing economies along with trade and geopolitical uncertainties encourage caution and readiness to dynamically adjust portfolio positions. It is difficult to expect a repeat of the strong equity gains of the last two years, helped as they were by rising profitability and higher earnings multiples.

We are allowing cash to build, limiting overall equity positions to no more than neutral weights, while we remain underinvested in fixed interest as yield curves continue their steepening trend and tight credit spreads offer poor compensation for inherent risks. Individual equity holdings focus ever more on offerings protected by higher quality and significant discounts to underlying value.

Positive sentiment for equities for now is provided by rate cuts which stimulate activity, reduce interest costs and decrease the discount rate for financial assets so long as longer-term interest rates fall as well. Market leadership has been rotating since the middle of the year. It is possible that the dominance of US mega caps could broaden into next year as lower interest rates support more cyclical businesses.

Of concern is the broad market expectations of soft landings with limited catering to alternate outcomes. Investors may be shocked should economies soften more than expected or if the strength of activity continues to surprise, thereby halting inflation’s decline. Rising advanced nation government debt increases the sensitivity to external shocks. Bull markets don’t tend to die of old age but are typically stopped by issues that are difficult to foresee ahead of time.

FREE Special Report: How to Jump ahead of competitors and add more value for clients

Learn how you can boost profits while enhancing customer outcomes.