A constructive environment for growth assets like shares and property is supported by modest global economic expansion, accommodative monetary policy and increasing fiscal support. However, several risks cloud the outlook so our portfolio positioning is more conservative than might otherwise be the case.

Key concerns are full asset prices, political uncertainties, high global debt levels, the potential for renewed concerns over China growth and the declining impact of monetary policy.

The equities bull market that commenced in 2009 continues, but the cycle is maturing. There is likely to be a series of market selloffs over the next period which will offer opportunities to add to growth-asset positions more cheaply. In readiness, we have built cash buffers in our portfolios.

Job growth the key to global expansion

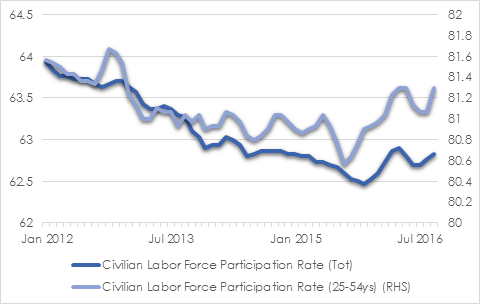

Global growth remains subdued but there is continued improvement from the concerns earlier this year. Developed economy growth remains slow, challenged by excess capacity, modest productivity growth, constrained fiscal action and high sovereign debt levels. Employment is growing but wage rises are only slight because labour markets remain relatively slack despite declining working-age populations.

Emerging market growth is becoming more important to global conditions as large emerging markets like China and India continue to expand at well-above average rates. Emerging economies are recovering as recessions recede now commodity prices are bouncing and the US dollar is not appreciating like it was in 2015, stressing US-dollar indebted corporates and sovereigns. The likelihood of low developed market interest rates for an extended period creates a more benign environment for emerging market growth. The path of US rate rises appears more modest than it did a year ago.

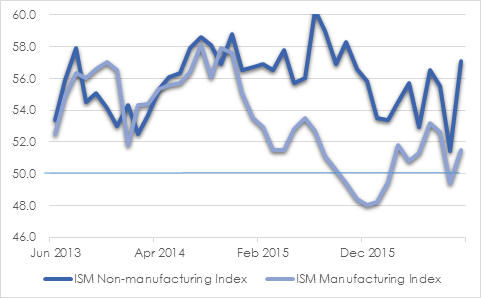

In the US, the sharp rise in September 2016 manufacturing and services activity after a period of weakness indicates the economy is gaining momentum as the year progresses. Services activity, the bulk of the economy, continues robust growth. Manufacture has returned to growth after a period of contraction relating to weakness in the energy sector and dampened external sector following the 2015 rise in the US dollar.

Subscribe to our newsletter to view the rest of this content

You have Successfully Subscribed!

Contact Us

Let us demonstrate how we can deliver outstanding outcomes for you.

p +61 2 8094 8410

e [email protected]

About AssureInvest

AssureInvest is your trusted professional investment partner. We offer a holistic and successful investment approach and carefully tailored solutions for individual needs, as well as cost saving innovations, integrity at the highest level and attentive customer service.

Our advisor clients are empowered to boost their profits and deliver better investment outcomes, benefiting their clients and the broader community.

Our disciplined and long term focus provides a critical framework for assessing new value-adding opportunities, preserving capital, generating superior returns and implementing at low cost.

Copyright

Copyright © 2016 AssureInvest Pty Ltd ABN 55 636 036 188 (AssureInvest). All rights reserved. No part of this publication may be reproduced or distributed in any form without prior consent in writing from AssureInvest.

Disclaimer

AssureInvest has taken all care in preparing this presentation and the data, information and research commentary within it (together referred to as the ‘publication’) but to the extent that the publication is based on information received from other parties no liability is accepted by AssureInvest for errors contained in the publication or omissions from the publication. AssureInvest gives neither guarantee nor warranty nor makes any representation as to the correctness or completeness of the publication. AssureInvest bases its data, information and research commentary on information disclosed to it by other parties. Past performance is no guarantee of future performance.

General Advice Warning

The information contained within this publication is of a general nature only. No information contained in the publication constitutes the provision of securities advice. AssureInvest warns that: (a) in preparing the publication, AssureInvest did not take into account the particular goals and objectives, anticipated resources, current situation or attitudes of any particular person; and (b) before making any investment decisions on the basis of that publication, any investor or prospective investor needs to consider, with or without the assistance of a securities adviser, whether the information contained within the publication is appropriate in light of the particular goals and objectives, anticipated resources, current situation or attitudes of the investor or prospective investor. If the information contained in this document relates to the possible purchase of a financial product, the client should consider the relevant product disclosure statement (PDS) before making any decision.

Disclosure

AssureInvest has no debt or equity relationship with any funds management or financial advisory group. AssureInvest may have an interest in the securities referred to in the publication in that AssureInvest and/or its staff may hold or intend to hold deposits, shares, units or other rights in respect of such products and from time to time AssureInvest may provide some of the investment product providers mentioned in the publication with research, consulting and other services for a fee.

AssureInvest Pty Ltd

ABN 55 636 036 188 AFSL number 47897

FREE Special Report: How to Jump ahead of competitors and add more value for clients

Learn how you can boost profits while enhancing customer outcomes.