Share prices are likely to further appreciate as investors gain greater confidence in the ongoing economic recovery at a time when interest rates are historically low. That said, reasonably high starting valuations reduce the return expectations over our five-year forecast horizon.

Our overarching focus in our individual company selections remains on companies promising sustained earnings growth through advantageous industry positioning. However, we have recently added to attractively valued cyclical exposures set to benefit from the improving economy.

Valuation gaps exist in the market between the health crisis winners and losers, with prices of some of the winners becoming stretched. Several of our selections should positively re-rate as activity eventual recovers through lifted services, release of pent-up demand and jump in business investment.

Economies will not return exactly as they were before, as several longer-term trends have been escalated. Here we discuss the key themes influencing our portfolio decisions.

Economic recovery from pandemic downturn

The global economy is beginning to recover from the Covid-19 shock which in time should leave little everlasting damage. The virus itself may remain with us indefinitely but vaccines and other treatments in development reduce the health risks and allow economies to open more fully and sustainably.

Emergence from recession together with low interest rates is supportive for equities, particularly cyclical and commodity exposures, though portfolio gains may be constrained by reasonably high starting valuations, steepening yield curves and low cash returns.

Services activity will surge as vaccines are delivered in the second half of this year. Freed from constraints, in-person activity and mobility will lift, reducing the rush in online demand. Goods demand should remain elevated but grow more moderately. Jobs are recovering quickly though unemployment may take two years or more to return to pre-pandemic levels given skills mismatches and rising workforce participation.

The lift in activity may be more rapid than that experienced after many past recessions. The downturn was prompted by an external event rather than a more typical collapse following a build-up of excesses requiring an extended period from which to transition. The economies were far from running hot, in fact global trade tensions in 2019 had weighed on business confidence and spending.

Household balance sheets and banking system capital levels appear broadly in good shape. The build-up in private savings during 2020 provides a solid platform for consumption as this year progresses. The downturn in China and Asia Pacific was less steep than in other regions and recoveries are set to be stronger given the good record in managing the virus and rising demand for technology and capital equipment, thus adding to the growth impetus globally.

Profits should rise much faster than GDP through revenue growth and constrained costs. Businesses, particularly large ones, are benefiting from low-cost funding, streamlined operations and greater dynamism and preparedness to deal with changing circumstances.

International monetary and fiscal policy remaining expansionary

Generous government income support has helped companies and individuals through the downturn and provide leverage to improving conditions. The inclination toward fiscal stimulus will decline as vaccines are distributed and debt levels rise, but support is unlikely to be removed quickly to ensure that the jobs recovery continues. Budget deficits will start to narrow, but not as quickly as private savings will reduce. Democrats with greater influence in Washington are likely to facilitate increased spending on the pandemic recovery, jobs, infrastructure and green energy programs, funded through increased taxes down the line.

Monetary policy will remain stimulatory while inflation pressures remain mild. Central bank bias is heavily toward supporting downside risks and reluctance to tighten in response to positive developments. After several years of failing to lift inflation to target levels, central banks plan to be slow in responding to signs of lifting prices. Monetary tightening is unlikely for at least two years though some of the emergency facilities like asset purchases may be tapered in the US and Australia by early next year, requiring careful communication by policymakers to avoid unsettling markets.

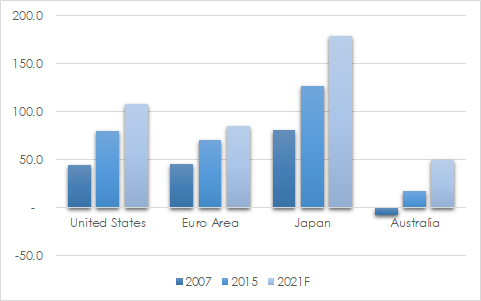

CHART 1: GOVERNMENT DEBT TO GDP

Source: IMF

Inclusive and sustainable growth

There is mounting political concern over growing wealth inequality that has been a cause of the rise of populism and other displays of social unrest. Monetary expansion in the last decade has tended to favour wealthier households by driving up asset prices. Technological disruption and globalisation appear to have had a disproportionately negative impact on the job prospects of less wealthy people.

Increased public investment in affordable housing, education and healthcare will generate opportunities for businesses providing innovative and personalised solutions in these areas. Ageing populations mean older citizens are becoming a more powerful consumer force with positive implications for travel, healthcare, insurance and wealth management service providers.

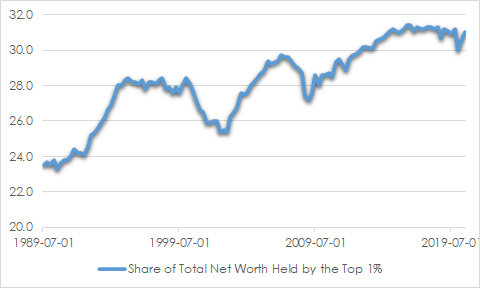

CHART 2: US GROWING INEQUALITY

Source: St Louis Fed

Individuals continue to alter behaviour to reduce their impact on the environment and this is encouraging companies to reassess their operational practices. The growth of funds invested within certain environmental, social and governance (ESG) guidelines creates opportunities for businesses contributing to a less polluting and more sustainable economy.

Inflation to lift more than the market is expecting

Inflation is likely to drift higher with lifted demand in depressed sectors, continuing monetary and fiscal stimulus, higher commodity prices and greater political support for labour. The yield curve should continue steepening as short-term interest rates are anchored by central banks on hold for possibly more than two years. Interest rates will still be low by historical standards so the positive environment for shares and property should continue for a while yet.

In the medium-term however, the threat of higher inflation and bond yields is more significant, and markets are yet to factor this into asset prices. High household savings rates could unleash a wave of spending while commodity prices head higher. Inflation should also lift to the extent that globalisation retreats as companies restructure supply chains and government encourage local production to support jobs.

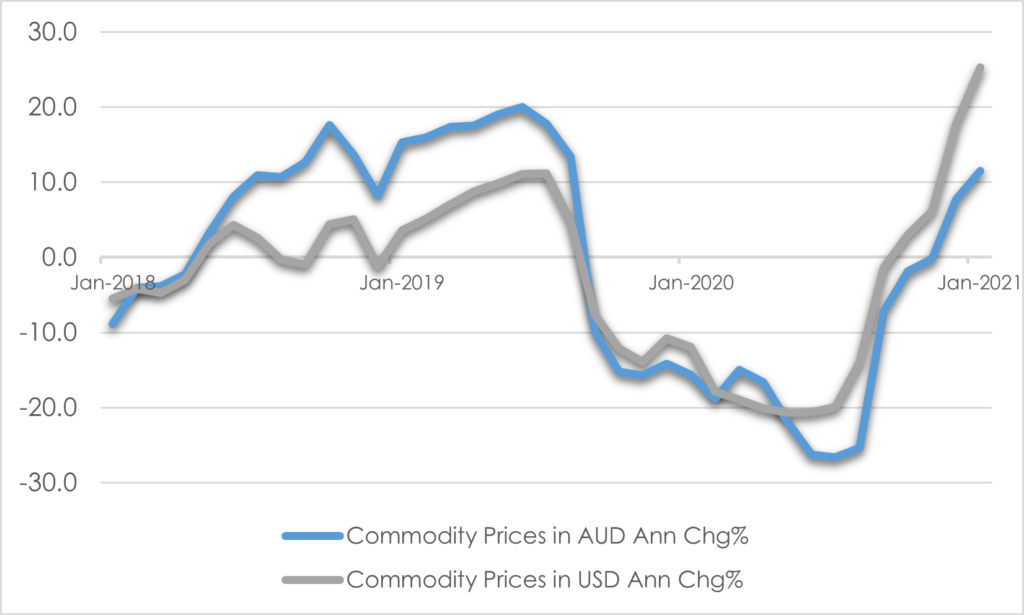

The commodity price outlook is positive given the economic rebound particularly in Asia given the relatively good effort in managing the virus, lifted global trade and constrained supply growth. Commodity prices globally have lifted 25.3% in US dollar terms in the last year or 11.5% in Australian dollar terms. Iron ore prices should remain elevated over the next year or more given rebounding China steel demand, new infrastructure spending programs internationally and constrained supply through near-capacity output from Australian producers and ongoing issues in Brazil. Copper prices have rallied in recent months but should hold well considering constrained supply and growing demand.

CHART 3: COMMODITY PRICES

Source: RBA

Questions over the ability of central banks to contain rising inflation in the future could prompt a lift in inflation expectations. Large government debt levels are currently funded by very low interest rates. The US Federal Reserve has indicated that it would accept higher inflation for a period so that price rises average 2% over a period rather than stop at 2% once it gets there. If inflation lifted much above 2%, the US Federal Reserve may not be able to raise rates high enough to weigh sufficiently on prices because of the heavy burden that would place on the government financing its debt.

Innovation altering competitive landscapes

The rapid pace of innovation and technology adoption is altering competitive landscapes in various industries. Highly scalable technology-enabled businesses have vast international sales potential with boosted profitability through low capital requirements and low marginal cost of sales. Several of the businesses we own in client portfolios benefit from these advantages.

The trend to digitise remains strong given the wide array of devices connected to the internet, innovations supporting new services and more efficient production methods and the incentives to adapt more rapidly to changing customer preferences.

Benefiting from this trend are companies offering new telecommunication technologies, telecommunications infrastructure construction and maintenance firms, medical device and online medical services providers and internet platform providers that are disrupting traditional businesses across various sectors.

The shift toward working from home is boosting demand for household goods, renovations and upsizing to suburban homes with space for work and home schooling. Changed consumer preferences are being displayed in greater take-up of direct-to-consumer digital services like exercise, digital healthcare, online retail, media streaming and online higher education.

Andrew Doherty. AssureInvest

A version of this article first appeared in SMSF Adviser.

© 2021 AssureInvest Pty Ltd (ABN 55 636 036 188 AFSL number 478978). No part of this publication may be reproduced or distributed in any form without prior consent in writing from AssureInvest.

The Information constitutes only general advice. In preparing this document, AssureInvest did not take into account your particular goals and objectives, anticipated resources, current situation or attitudes. Before making any investment decisions you should review the product disclosure document of the relevant product and consult a securities adviser. Past performance is no guarantee of future performance. This document is not intended for publication outside of Australia.

FREE Special Report: How to Jump ahead of competitors and add more value for clients

Learn how you can boost profits while enhancing customer outcomes.