The short-term focus of too many investors is extremely destructive of the wealth they have built up over their lifetimes. The sharp market selloffs since the middle of 2015 demonstrate periods where primal fear takes over and many people sell purely because others are selling.

At the individual level, short-termism can slash the value of investors’ capital and limit their ability to fund a comfortable retirement. It is also damaging at society level as an acute emphasis on near-term performance incentivises corporates to pursue quick-fix remedies to prop-up profits, resulting in sub-optimal longer-term outcomes.

Investors tend to generate better results when their investment choices are based on conviction about the long-term trend, particularly when they choose businesses that are competitively well placed to flourish. As sentiment is the key driver of short-term share prices, investors with a long-term view can use market selloffs as opportunities to buy attractive companies more cheaply. These investors benefit as share prices rise over time toward their underlying true worth, without necessarily knowing exactly when this will occur.

AssureInvest has identified five key long-term investment themes for the next decade. Well-positioned companies benefiting from these trends should be on the short-list for long-term investor portfolios.

1. Technological Disruption

Innovation is dramatically altering a great number of industries at speeds rarely seen before. Investment opportunities are available in the disruptors themselves as well as companies that benefit from the new technologies.

- In financial services, business managers are reappraising their approaches as digitisation reduces the cost to service customers across banking, wealth management and insurance. For instance, there appears to be tremendous potential for developing blockchain technology to remove multiple post-financial transaction back office layers from banks and broking firms. A blockchain is a public ledger of all transactions.

- In energy, new technologies have allowed rapid expansion in supply from shale and other unconventional natural gas resources while new batteries are being developed to enable large-scale energy storage.

- Health care is being revolutionised via mobile health, wearable sensors and next generation genomics which assists medical practitioners manipulate genes and improve health diagnostics and treatments. There are now a number of websites offering quick and easy online medical consultations like doctus.com.au and drsicknote.com.au.

- In education, online resources are reducing costs and lifting teaching standards no matter where the student is.

The shift from traditional media and retail to online/digital has been occurring for a number of years. Take-up of online television and movie services like Netflix and music services like Spotify and Pandora demonstrate how rapidly consumers can switch to new digital subscription content offers from live-to-air networks. Many traditional retailers are yet to embrace digital technology as a strategic focus, being held back by legacy systems and old business practices. This leaves them prone to attack from younger and more flexible and scalable rivals.

Disruptive technologies are in strong demand due to the better consumer experiences that are being offered. Innovative solutions are fulfilling customer needs in far more compelling ways. New consumer products and services are making consumers’ lives easier and new business solutions are helping companies expand revenues and reduce costs. Social media platforms for example allow companies to cut marketing costs as well as reach new audiences. Websites like Linked-in, Twitter and Google+ are amongst the cheapest arenas in history for companies to distribute their marketing content.

“Disruptive forces should continue for some time due to rapid declines in start-up costs, especially as digitisation spreads, computer power increases and digital device use surges”

Disruptive forces should continue for some time due to rapid declines in start-up costs, especially as digitisation spreads, computer power increases and digital device use surges. New entrants can quickly challenge traditional provider profits as they are devoid of the encumbrances of inherited cost bases and old fashioned cultural approaches.

The “Internet of things” — the ability to transfer data over a network without human interaction — is another game changing area of advancement. Business consultancy McKinsey believes that global value of US$4 to 11 trillion will be created by 2025 as this technology becomes more prevalent. Some of the areas set to benefit most are factories, through more efficient operations management and predictive maintenance, public infrastructure, through better traffic control and resource management, health care, though better monitoring and management of illness, and retail, through self-checkout and smarter customer relationship management.

New technologies are creating powerful “network effect” opportunities. Network effects relate to goods and services that become more valuable with increasing numbers of users. New telephone networks are a good example – if only one person uses a new network, they will not be able to call anyone else! As more people join the network it becomes increasingly useful.

New marketplace providers offer better user experiences with more connectivity and value-added technology features, like the property data and map information offered on realestate.com.au.

Facebook’s value proposition is connecting people with their friends. Its utility is different according to each user’s situation and time budget. The ability to capture user content extends the service. As more users comment on websites like TripAdvisor, online recommendations and endorsements become more helpful.

2. Emerging Asian Middle Class

Continued explosive growth of China and India’s middle classes create opportunities for consumer goods suppliers with offerings diversified beyond the standardised products commonly sold in these regions. Entertainment, food service, technology and other industries stand to benefit.

As emerging market wealth increases, there is rapid growth in the number and the purchasing power of the middle class population. Most of the new members of the middle class are from China and India. The World Bank expects the global middle class to more than double from 430 million to 1.2 billion people between 2000 and 2030, with most of this growth from emerging markets.

“The World Bank expects the global middle class to more than double from 430 million to 1.2 billion people between 2000 and 2030, with most of this growth from emerging markets”

Consumption growth in China remains strong despite the recent slowing in overall growth. Consumption as a percentage of Chinese GDP declined from 51% in 1985 to 34% in 2013 as a result of efforts to boost growth through investment, according to McKinsey. As a part of its “rebalancing”, just returning consumer spending back to 2005 levels of 43%, would create the largest consumer market in the world.

As for India, McKinsey estimates that if current high growth continues, it will rise from being the world’s twelfth-largest consumer market to the fifth by 2025. In this period, more than 291 million people will move out of abject poverty, and the middle class will expand over ten times to 583 million people. During that period, India’s middle class will rise to 41% of the overall population from 5% now. The wealthiest Indians will number over 23 million.

As wealth increases, the proportion of income spent on discretionary items rises. Luxury brand producers are clear beneficiaries via the greater ability to purchase status symbols and rewards for hard work. Demand for services is also likely to rise, particularly in education, financial services and local and international travel and leisure. Demand for western-style food is also likely to grow.

3. Aging Western World Populations

Aging baby-boomers and extended life expectancy is increasing the proportion of the population in older-age categories, boosting demand for services like health care and financial services. Aging and longevity leads to greater spending on medicines and treatments as well as services like leisure, aged care, insurance and wealth management.

The proportion of developed country populations aged 60 or over grew to 23% in 2013 from 12% in 1950 according to the World Bank. This figure is expected to rise to 32% by 2050.

“Aging and longevity leads to greater spending on medicines and treatments as well as services like leisure, aged care, insurance and wealth management”

Aging places significant pressure on already highly indebted government finances and will place a heavy tax burden on overstretched younger generations. Favourable regulation can be expected for businesses that assist governments to fund rising health care costs.

The intergenerational wealth transfer from baby boomers to their heirs may be the largest wealth transfer in history. This provides valuable opportunities for financial services and consumer goods suppliers. Accenture Consulting expects US$30 trillion to be transferred between generations in the next 30 to 40 years in North America alone.

4. Mobile Data Addiction

Growing business and consumer data use especially on mobile devices will boost demand for bandwidth and mobile subscriptions. Changing business and consumer behaviour is being driven by faster network speeds, rising popularity of digital platforms and more powerful portable devices.

Wireless traffic should continue to grow through increased penetration and use of smartphone and tablets to perform a wider range of functions including voice, text, email, calendar management, gaming, music, internet access and an expanding array of other applications.

By the end of 2015 global mobile penetration was 97% according to International Telecommunications Union. There were over 7 billion mobile subscriptions, up from 738 million in 2000. Mobile broadband subscriptions reached 47% of the global population, 12 times the 2007 figure.

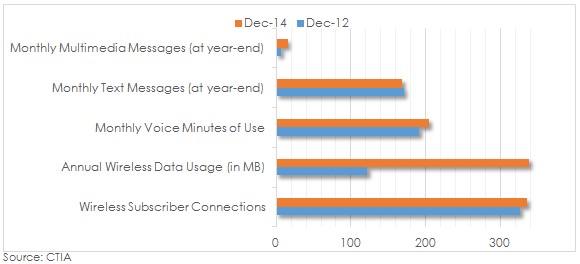

Mobile device users continue to share more information. Indicatively, US monthly wireless data usage grew 66% per annum to 338.4 billion megabytes in the two years to December 2014. Monthly voice minutes grew 3% pa and monthly text messaging fell by 1% per annum but multimedia messages grew 48% per annum to 15.4 billion.

Wireless subscriptions have grown only 1% per annum in the period, but smartphones and tablets which make it easier for users to access and share multimedia content make up a greater share of devices.

MOBILE DATE USE GROWTH

5. Growing Investment Asset Pool

Compulsory superannuation payments ensure a rising investment asset pool driven by Australia’s expanding population and moderately rising wages. This trend provides a significant tailwind for Australia’s financial services providers.

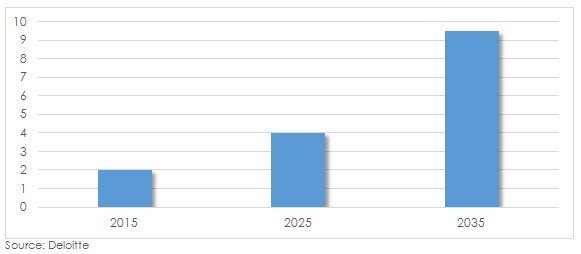

Deloitte expects Australia’s superannuation system to double to $4 trillion by 2025 and reach $9.5 billion by 2035. Superannuation assets will grow from 120% of GDP currently to over 200% in 2035. Supporting growth expectations, the Superannuation Guarantee will rise to 12% in July 2025 from 9.5% now. The next scheduled increase is to 10% in 2021.

AUSTRALIAN SUPERANNUATION ASSETS ($TRILL)

A version of this article first appeared in SMSF Adviser Magazine.

——————————————————-

Contact Us

Let us demonstrate how we can deliver outstanding outcomes for you.

p +61 2 8094 8410

e [email protected]

About AssureInvest

AssureInvest is your trusted professional investment partner. We offer a holistic and successful investment approach and carefully tailored solutions for individual needs, as well as cost saving innovations, integrity at the highest level and attentive customer service.

Our advisor clients are empowered to boost their profits and deliver better investment outcomes, benefiting their clients and the broader community.

Our disciplined and long term focus provides a critical framework for assessing new value-adding opportunities, preserving capital, generating superior returns and implementing at low cost.

Copyright

Copyright © 2016 AssureInvest Pty Ltd ABN 55 636 036 188 (AssureInvest). All rights reserved. No part of this publication may be reproduced or distributed in any form without prior consent in writing from AssureInvest.

Disclaimer

AssureInvest has taken all care in preparing this presentation and the data, information and research commentary within it (together referred to as the ‘publication’) but to the extent that the publication is based on information received from other parties no liability is accepted by AssureInvest for errors contained in the publication or omissions from the publication. AssureInvest gives neither guarantee nor warranty nor makes any representation as to the correctness or completeness of the publication. AssureInvest bases its data, information and research commentary on information disclosed to it by other parties. Past performance is no guarantee of future performance.

General Advice Warning

The information contained within this publication is of a general nature only. No information contained in the publication constitutes the provision of securities advice. AssureInvest warns that: (a) in preparing the publication, AssureInvest did not take into account the particular goals and objectives, anticipated resources, current situation or attitudes of any particular person; and (b) before making any investment decisions on the basis of that publication, any investor or prospective investor needs to consider, with or without the assistance of a securities adviser, whether the information contained within the publication is appropriate in light of the particular goals and objectives, anticipated resources, current situation or attitudes of the investor or prospective investor. If the information contained in this document relates to the possible purchase of a financial product, the client should consider the relevant product disclosure statement (PDS) before making any decision.

Disclosure

AssureInvest has no debt or equity relationship with any funds management or financial advisory group. AssureInvest may have an interest in the securities referred to in the publication in that AssureInvest and/or its staff may hold or intend to hold deposits, shares, units or other rights in respect of such products and from time to time AssureInvest may provide some of the investment product providers mentioned in the publication with research, consulting and other services for a fee.

AssureInvest Pty Ltd

ABN 55 636 036 188 AFSL number 478978.

FREE Special Report: How to Jump ahead of competitors and add more value for clients

Learn how you can boost profits while enhancing customer outcomes.