Positive returns comfortably ahead of inflation can be expected over the longer term but full valuations in some areas, despite recent selloffs, and likely slowing in economic activity encourage a cautious stance for now.

Economic growth this year has been stronger than expected in most regions. There should be a more significant slowing in the next several months, especially in the United States, while Europe and China continue mild expansion paths. However, a strengthening is likely through next year helped by lower borrowing costs, household income growth above inflation, supportive government policies and intensified investment in artificial intelligence and the reshoring of manufacture.

Recession in the US is still possible before the end of the year. Economic data encouraging rate cuts have been mounting for several months. Interest rates held higher for longer in response to persistently high inflation are dragging activity with a lag. Consumption will continue to be gradually constricted by falling savings, weakening jobs markets, lower wages growth and moderating but stubbornly high living costs.

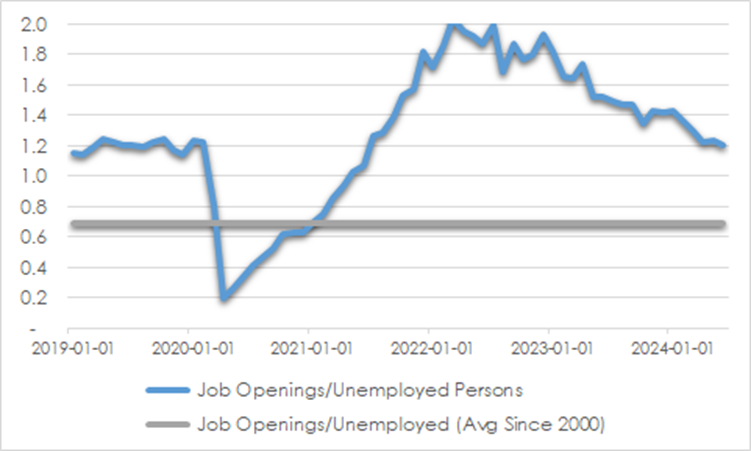

The period of extremely strong labour markets that assisted the post-pandemic recovery is coming to an end. Unemployment has been slowly rising in the last two years but may lift more significantly in the next several months. The supply of new jobs is declining at a time that participation in the workforce is being boosted by a revival in immigration. The proportion of US job openings relative to unemployed people is still far above average but is now 1.2 times compared with the peak of 2.0 times in 2022.

CHART 1: US OPENINGS/ UNEMPLOYED

Source: St Louis Fed, AssureInvest

The discrepancy is growing between wealthier households and corporates who locked in borrowing at lower interest rates and other individuals where stresses are beginning to surface. US credit card delinquency rates are rising and there are ongoing challenges in commercial real estate faced with higher debt charges and changed work patterns. However, these risks do not appear systematic. Many stretched borrowers are rolling debt forward without significant troubles.

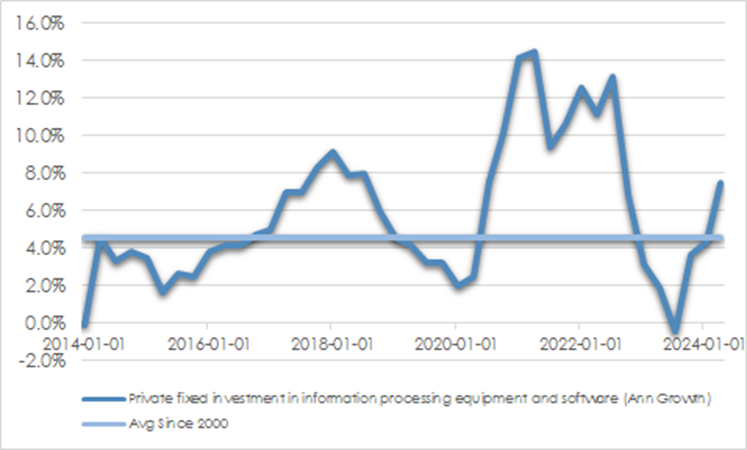

Global economic conditions are likely to be more stable through next year helped by healthy consumer and corporate balance sheets and solid, if cooler, jobs markets. Manufacturing has been weak since 2022 but should benefit from completion of the post-pandemic drawdown in excess inventories. Services demand should be buoyed by improving sentiment as inflation fades. Business investment ought to be encouraged by cyclical factors and artificial intelligence and other innovations. Information processing spending has already jumped in recent months.

CHART 2: US INFORMATION PROCESSING INVESTMENT

Source: St Louis Fed, AssureInvest

Uncertainty is being boosted by geopolitical stresses and possible shifts toward even more populist political measures related to US elections. Changes to US public policy may include increased deficit spending, lifted tariffs, altered immigration policies and changed regulations. These may add modestly to US inflation but are unlikely to alter the recovery path.

Key central banks to ease policy before year end

Inflation across many advanced economies has declined to a range of 2-3%. This rate remains above targeted levels but is significantly below that of two years ago when monetary policy was first tightened. Australia remains an outlier with inflation of 3.8% for the year to June 2024. Goods inflation has declined significantly while services inflation remains elevated because of tight labour and housing markets.

It may take more than a year for inflation targets to be reached. This will be helped by softer wages growth as jobs demand comes into better balance with supply and lower rent inflation as housing construction picks up. There is also increasing evidence of consumers pushing back on price rises and seeking value-oriented products.

Easing of monetary policy is underway but the stickiness of underlying inflation means rate cuts may be fewer and more drawn out than some investors expect. US Federal Reserve Chair Jerome Powell for several months has been indicating a keenness to commence the rate cutting cycle soon. There is an increasing recognition that the longer rates are held at relatively high levels, currently 5.25-5.50%, the greater the eventual damage to the economy. The cooling in the labour market is shifting the emphasis toward the need for the Fed to maintain full employment as well as contain inflation. The Fed hopes inflation will further moderate without too much damage to the labour market that may pre-empt a recession. However, once the labour market begins softening, unemployment can rise sharply.

We anticipate 50 to 100 basis points worth of rate cuts in the US by Christmas and 150 to 200 basis points in total between now and the end of next year. The European Central Bank could cut rates slightly more significantly than the Fed over that period given Europe’s weaker underlying conditions and greater sensitivity to interest rates.

Investment Strategy

As contrarians we often find the best investment opportunities among strong companies going through temporary troubles showing in weak share prices. Market misconceptions can lead to businesses being out of favour. With patience, these can rise in value as the market catches up in time.

We continue to find value among select higher-quality companies. Internationally we still prefer larger market capitalisation firms with structural growth opportunities. Despite their valuation advantage, cyclical and smaller cap companies may disappoint investors given their greater sensitivity to near term economic weakness. Official interest rates are being cut late in the cycle. Their flow on benefits will not show in improved economic data until well into next year. By that time, broader based margin expansion can be expected, helped by volume gains and easing input costs.

Equally, investors are not fully appreciating the risks of inflation remaining uncomfortable high for an extended period. Longer term bond yields may not be able to fall as much as many investors are hoping and this would put an additional weight on expected risk asset returns.

We maintain our broadly neutral stance to growth assets. We have gradually raised cash levels during the year as valuations became more challenging and economic growth began to roll. Heightened volatility can be expected in the remainder of the year. We are underweight US equities where the market has been underestimating the slowdown that is starting to be reflected in weaker manufacturing and employment data while overestimating the artificial intelligence-linked mega-cap earnings surge. We are overweight European equities where valuations are far more attractive. A higher proportion of European stocks have cyclical earnings which should gain from the improving economic backdrop next year particularly as lower energy costs and rising real wages help consumers.

In Australian equities, we have elevated cash ready to withstand near-term volatility and will be able to make use of this by adding to oversold businesses with strong industry positions and the power to lift prices above inflation. Our preference is for structural growth entities such as in the healthcare sector where demand profiles are less impacted by economic instability while heightened post-pandemic costs are dissipating. We also see select opportunities in more cyclical areas like consumer discretionary, industrials and real estate, particularly where panicky investors sell these down too harshly.

Andrew Doherty. AssureInvest

The Information constitutes only general advice to wholesale investors. In preparing this document, AssureInvest did not take into account your particular goals and objectives, anticipated resources, current situation or attitudes. Before making any investment decisions you should review the product disclosure statement of the relevant product and consult a securities adviser. Past performance is no guarantee of future performance. This document is not intended for publication outside of Australia.

FREE Special Report: How to Jump ahead of competitors and add more value for clients

Learn how you can boost profits while enhancing customer outcomes.