Collaborating with a trusted investment expert allows advisors to extend their services to more people. Not only do individuals benefit from access to financial guidance, society as a whole is better off because more people are making better decisions with their wealth.

By outsourcing investment management, advisors can expect to better meet the needs of consumers, boost the scalability and efficiency of their practices and spend more time on value-adding strategic work.

Streamlined firms devote additional time to meeting clients, understanding their needs and explaining inventive solutions. With a more personalised, holistic service and robust investment approach boosting investment returns and reducing risks, advisors will have a stronger proposition with which to retain and grow the value of their customers over time.

People are better off with investment guidance

Most individuals are better off being guided by financial professionals than managing their investment portfolios on their own.

All too often there is very little diversity across asset classes with a heavy weighting to Australian shares. There is often too little exposure to more defensive-style assets like fixed interest so individuals are at risk of not being able to fund their retirement if markets fall at the wrong time.

The ideal asset allocation depends on a number of factors that individuals can better weigh up with the help of an advisor. These include, their stage of life, planned term of investment, requirement for income and tolerance of volatility.

Research by David Blanchett and Paul Kaplan of Morningstar titled “Alpha, Beta, and Now . . . Gamma” in 2014 shows that advisors help individuals generate around 1.6% additional return each year. This creates around 22% higher retirement income. This result shows that advisors have a significant impact on retirement income, even after the advice fee of say 1% per annum.

Research at Queensland University of Technology found that obtaining financial advice boosts client wellbeing. After surveying financial planning clients before and after receiving advice they found that after taking advice “clients feel more in control of their finances, have lower levels of stress, are more comfortable with their situations, are more prepared for contingencies, and put more effort into their finances than before.” (Irving, Gallery, Gallery and Newton, Queensland University of Technology, I can’t get no satisfaction … or can I? An exploratory study of satisfaction with financial planning and effects on client well-being, June 2011.)

Financial services research firm Dalbar Inc. has demonstrated that individuals have a poor record of managing their portfolios on their own. It found that individuals’ decisions detract from wealth. They tend to sell after making paper losses, invest only after the market has rebounded and don’t remain invested for long enough to derive sufficient benefit.

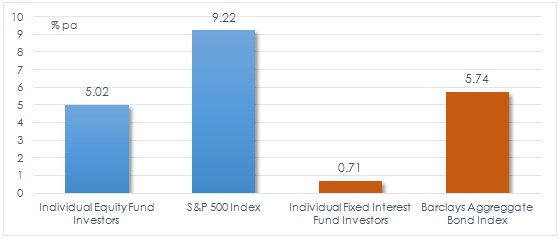

In the 20 years to 2014, the United States S&P 500 rose 9.2% per annum but individual investors making applications and redemptions in equity managed funds returned just 5.0% per annum. While bonds returned 5.7% per annum, individual bond fund investors produced only 0.7% per annum. These results are despite the fact that the funds they invested rose broadly in line with the index on average. (Source: Dalbar, Inc, Quantitative Analysis of Investor Behaviour, 2014.)

INVESTOR VERSUS INDEX RETURNS 1994 – 2014

Source: Dalbar, Inc, Quantitative Analysis of Investor Behaviour, 2014

What advice consumers want

Our market research over the last two years highlights the following needs among individuals seeking financial advice:

- Manage complexity – Advisors can help make their customers’ lives dramatically simpler by helping cut through the mass of complex information associated with their financial affairs. The problem with unfettered complexity is that poor decisions may be made due to lack of time and understanding. Good advice provides a valued roadmap for the future.

- Achieve financial goals – A good financial advisor will use their extensive experience to help their customers plan their finances, maximise the use of their assets and reach their financial goals.

- Peace of mind – Investors seek security in the knowledge their affairs are being looked after well by skilled professionals. Providing a well-managed portfolio means investors have one less thing to worry about.

- Greater control – Individuals feel empowered to take their financial future in the direction they desire by having the information and guidance from a financial advisor they can trust.

- More engagement with their advisors – Trust is central to the advice relationship so individuals seek rich communication where advisors can demonstrate attentiveness and skill. Customers want a thorough process and personalised service. A number of advisors are putting their time into building direct security portfolios for their clients. This is in response to the demand for greater transparency, control, lower costs and a portfolio that specifically suits investor needs.

- Lower costs – There is a greater focus on costs as a result of the onslaught of robo-advice and greater fee transparency across the industry. Many advisors are responding by seeking more scalable and efficient organisations and by ensuring they provide a differentiated service.

Outsourced investing allows advisors to generate better customer outcomes

Partnering with a trusted investment partner enhances advisors’ capability to generate superior outcomes for their clients in a variety of ways.

- Tailored investment guidance provided by you – Investment management is a hugely time-consuming activity. It is beyond the capacity of most advisor firms on their own to support the management of a range of reliable portfolios suiting various customer needs. Collaborating with a trusted investment specialist allows advisors to easily match their customers’ unique goals and risk tolerance with the appropriate professionally managed portfolio. The resulting tailored portfolio is more likely to provide pleasing and targeted outcomes for each investor.Professional investors have different approaches to managing money. In our experience a disciplined, dynamically-managed, long-term focus on diversified, high-quality and attractively-valued assets, implemented at low cost, is more likely to preserve capital and generate superior returns over time than other methods.

- Enhanced relationship with you, their advisor – With outsourced investment arrangements, many investor customers will feel more confident that their capital is being reliably protected and will grow over time. Relationships between advisors and customers become more meaningful. Instead of deliberations over why a certain managed fund or other investment selection was made, conversations can be focused more at a strategic level. There is more time to create impacts that can dramatically boost the customers’ financial wellbeing.

- Informed via in-depth investment insights and online portfolio reports – Advisors can inform themselves and their customers about the investment outlook by utilising analytical reports provided by their investment partner. This knowledge should help individuals maintain a long term, objective view and make better decisions.Where administration is being outsourced, online portfolio reports allow investors to see what they own and what their holdings are worth at any time. Information typically includes portfolio performance, valuations, transactions, dividend payments, franking credits and any fees and costs.

- More engaged with their portfolios – Investors feel they have knowledge of, and influence over, their portfolio. This is particularly the case where they hold direct securities due to their greater transparency and control compared to managed funds unit trusts Greater investor engagement will help deepen the relationship with advisors and improve the chances of superior outcomes.

- Lower investment costs – The ability to reduce costs within portfolios depends on the investment style of the outsourced partner. Portfolios focused on direct securities will have far lower embedded product costs than if managed funds dominate. A low-turnover approach will also reduce costs through lower brokerage and related administrative expenses. By outsourcing investment management, advisors typically cut their expenses and have greater operating efficiencies. The benefits of these cost savings could be passed through to customers.

Copyright

Copyright © 2016 AssureInvest Pty Ltd ABN 55 636 036 188 (AssureInvest). All rights reserved. No part of this publication may be reproduced or distributed in any form without prior consent in writing from AssureInvest.

Disclaimer

AssureInvest has taken all care in preparing this presentation and the data, information and research commentary within it (together referred to as the ‘publication’) but to the extent that the publication is based on information received from other parties no liability is accepted by AssureInvest for errors contained in the publication or omissions from the publication. AssureInvest gives neither guarantee nor warranty nor makes any representation as to the correctness or completeness of the publication. AssureInvest bases its data, information and research commentary on information disclosed to it by other parties. Past performance is no guarantee of future performance.

General Advice Warning

The information contained within this publication is of a general nature only. No information contained in the publication constitutes the provision of securities advice. AssureInvest warns that: (a) in preparing the publication, AssureInvest did not take into account the particular goals and objectives, anticipated resources, current situation or attitudes of any particular person; and (b) before making any investment decisions on the basis of that publication, any investor or prospective investor needs to consider, with or without the assistance of a securities adviser, whether the information contained within the publication is appropriate in light of the particular goals and objectives, anticipated resources, current situation or attitudes of the investor or prospective investor. If the information contained in this document relates to the possible purchase of a financial product, the client should consider the relevant product disclosure statement (PDS) before making any decision.

AssureInvest Pty Ltd

ABN 55 636 036 188 AFSL number 478978.

FREE Special Report: How to Jump ahead of competitors and add more value for clients

Learn how you can boost profits while enhancing customer outcomes.