Significant financial market distortions have resulted from the fall in bond yields. The latter is in response to low inflation, central bank asset purchases and the flight to safety following Britain’s decision to leave the European Union (known as Brexit). A significant proportion of sovereign bonds offer negative yields, or in other words, guaranteed losses for investors holding to maturity.

Investors have responded with an ever-desperate hunt for yield, the continuation of a theme that has been in evidence since 2012. While we see shares as broadly fairly-valued on an absolute basis, they appear particularly cheap in comparison to unsustainably-expensive bonds.

More investors who would typically not accept equity risk have been drawn into the asset class on the promise of higher returns than they might achieve in cash or bonds. Troubles might occur for these investors over the next few years as bond yields gradually rise with modestly rising inflation and the ceasing of extraordinary monetary stimulus programs.

Conditions have improved from earlier in the year

Rebounded energy prices and a more moderate United States (US) dollar have helped conditions improve from the slowdown earlier this year. We anticipate further modest expansion, led by increasing consumption in the US and China and continued meek revival in Europe. We expect the globe to avoid a deep recession in the next couple of years that would derail the equities rally.

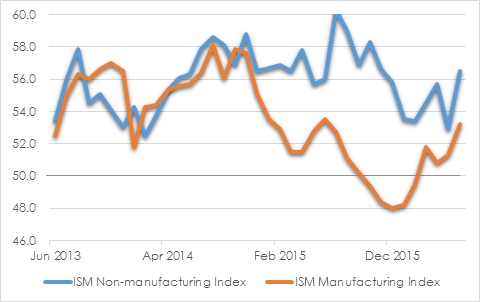

Industrial activity and services in the world’s largest economy are expanding again. A lift in manufacturing new orders indicates positive momentum for the remainder of the year.

CHART 1: US MANUFACTURE AND SERVICES GROWING AGAIN

Source: Institute Supply Management

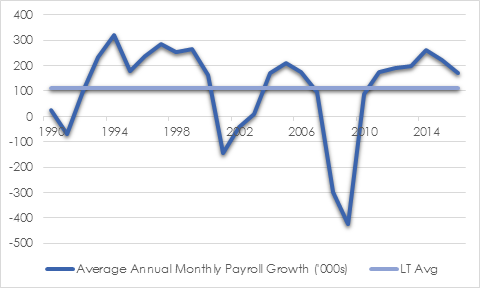

US wages growth is now around typical historic growth rates and will build further as the labour market tightens. The labour market continues to grow, though monthly average job creation has slowed to around 172,000 per month so far this year compared to 223,000 per month in 2015. A number of states will raise minimum wages this year which will contribute modestly to wages growth but also restrict job growth somewhat.

CHART 2: US MONTHLY AVERAGE PAYROLLS

Source: US Bureau Statistics

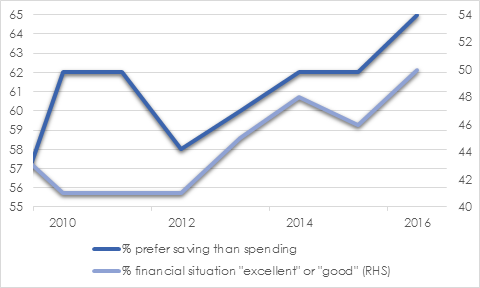

One factor that is constraining US growth is the increased preference for saving over spending. More people find saving more appealing than spending than at any time since Gallop Poll started gathering this data in 2001. This has occurred despite the rise in confidence in personal finances since the global financial crisis. The proportion of Americans that rate their financial situation as “good” or “excellent” is the highest since 2006. Actual savings rates have risen to around 5% from 2% in the last ten years. It will take a boost in confidence and certainty for this trend to revert.

CHART 3: FINANCIAL POSITION AND SAVINGS GROWING

Source: Gallop Poll. Note, data not collected in 2011

Brexit uncertainty to remain for some time

Brexit proceedings and related uncertainties are likely to prevail for a number of years. The paths Britain and the European Union take could lead in a variety of directions. British Prime Minister May will seek the best possible access to the single trade market while also seeking greater control over the numbers of people entering Britain, a critical issue that influenced the Brexit outcome.

Brexit could well be a game changer for the EU and may ignite real reform. The European Council statement soon after Britain’s referendum result evidenced that there is greater willingness to listen to the dissatisfaction among many people within EU and a readiness to have greater reflection that could give rise to further reforms.

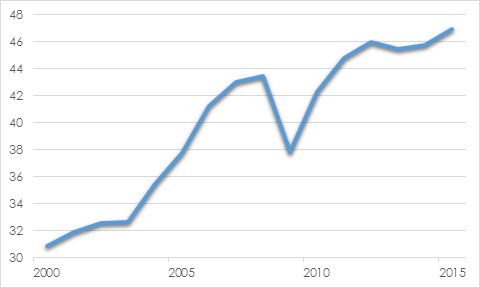

The EU has major incentivises to keeping the remaining twenty-seven members together by finding ways to enhance the benefits of membership. Germany, likely to be the European leader in negotiations with Britain, is probably the most motivated to making sure the EU and Eurozone continue to exist. Germany has become increasingly reliant on exports which would be hurt if members leave the Eurozone and experience depreciations in their currencies. German exports now represent 46% of GDP compared to 32% when the euro commenced in 2000.

CHART 4: GERMAN EXPORTS PERCENT GDP

Source: World Bank

Concessions on the free movement of labour could reopen opportunities for Britain to remain in the EU after all. Such moves may also help reduce the drive for other Brexit-style referendums while suppressing the rise of populist parties like Germany’s Alternative, Spain’s Podemos, Italy’s Five Star Movement and France’s National Front.

Fiscal expansion might be another way to help contain the rise in populism. Increased infrastructure investment could create employment within construction and related sectors and boost potential economic growth. The EU could also allow Italy to use public funds to recapitalise Italian banks which have under-provisioned for their non-performing loans worth EUR 360 million. This could diffuse the rise of the Five Star party which is threatening to pull Italy out of the Eurozone and EU. Such an event would have far greater implications for the future of those institutions than Britain leaving the EU.

Eventual rise in yields could destabilise share prices

The rally in bonds has gone too far. Yields have already started to rebound as the initial Brexit shock dissipates. We expect a further gradual rise in yields in the months ahead. With time will come greater clarity over new arrangements within the EU. There will be greater certainty that economic consequences for both the United Kingdom and Europe will be relatively modest. Major catastrophes are likely to be avoided.

We think the market is under-pricing the likely mild pickup in inflation over the next year or two, particularly in the US. Bond yields should steadily rise as inflation reverts to target levels and official interest rates increase. Rebounding oil prices and rising wages particularly in the US will have a meaningful impact over the next year. The rise in populism may also be modestly inflationary over time through the influence on governments to use fiscal measures to help address the growing concerns over income inequality.

The US Federal Reserve has paused its rate rise cycle in the face of weak international developments but continued evidence of an ongoing US recovery will encourage further hikes from later this year. This will also help to counter the various forces weighing down yields globally. We expect at least three US rate rises next year while the market is projecting one at best.

There is a limit as to how far monetary policy can go and there may be more of a push toward fiscal actions. Ultra-low interest rates are providing a stimulatory benefit, but there are also costs. Very low interest rates favour borrowers over savers, especially hurting older people living on fixed pensions. Negative interest rates hurt the ability of banks to generate profits as effectively the lender is paying a fee to the borrower. Corporates have taken the opportunity to refinance debt at lower rates but they have been more inclined to buy back their own shares than to undertake growth investments contributing to the weak revenue growth outlook.

“There is a limit as to how far monetary policy can go and there may be more of a push toward fiscal actions. Ultra-low interest rates are providing a stimulatory benefit, but there are also costs”

High public debt levels and fiscal imbalances mean that a coordinated fiscal campaign is unlikely unless there is a major downturn. Some regional expansionary programs are underway however, most notably in China, Japan and Canada.

Where to invest

Share prices are full but not excessive given the modest growth environment. Investors should have a neutral weighting to equities, the exact amount dependent on their unique goals and risk tolerance. It is wise to carry additional cash in order to readily take advantage of intermittent market sell-offs to buy high-quality assets more cheaply.

Within Australian equities, investors should be distrustful of overly-popular and now expensive bond-proxies, especially infrastructure-owners and real-estate investment trusts. Dividends are still likely to provide a high proportion of total returns given full market prices and modest economic growth. However, the best performing companies will be those delivering enduring growth in earnings through unique assets or skills and strong cash flow that supports a rising dividend stream.

Housing, consumption and liquid-nitrogen-gas (LNG) exports will help Australia grow faster than most developed economies in the next few years. Each of these areas are well-represented in AssureInvest portfolios.

“The best performing companies will be those delivering enduring growth in earnings through unique assets or skills and strong cash flow that supports a rising dividend stream”

It still makes sense to own fixed interest securities, but at a far lower-than-typical weighting given unsustainably low yields. Bonds play a critical diversification role in long-term portfolios. Bonds help hedge portfolio values against market disappointments that can significantly hurt growth-asset returns.

As always, patience and a focus on a tried and tested investment approach are vital.

A version of his article was first published in SMSF Adviser Magazine on 27 July 2016.

Contact Us

Let us demonstrate how we can deliver outstanding outcomes for you.

p +61 2 8094 8410

e [email protected]

About AssureInvest

AssureInvest is your trusted professional investment partner. We offer a holistic and successful investment approach and carefully tailored solutions for individual needs, as well as cost saving innovations, integrity at the highest level and attentive customer service.

Our advisor clients are empowered to boost their profits and deliver better investment outcomes, benefiting their clients and the broader community.

Our disciplined and long term focus provides a critical framework for assessing new value-adding opportunities, preserving capital, generating superior returns and implementing at low cost.

Copyright

Copyright © 2016 AssureInvest Pty Ltd ABN 55 636 036 188 (AssureInvest). All rights reserved. No part of this publication may be reproduced or distributed in any form without prior consent in writing from AssureInvest.

Disclaimer

AssureInvest has taken all care in preparing this presentation and the data, information and research commentary within it (together referred to as the ‘publication’) but to the extent that the publication is based on information received from other parties no liability is accepted by AssureInvest for errors contained in the publication or omissions from the publication. AssureInvest gives neither guarantee nor warranty nor makes any representation as to the correctness or completeness of the publication. AssureInvest bases its data, information and research commentary on information disclosed to it by other parties. Past performance is no guarantee of future performance.

General Advice Warning

The information contained within this publication is of a general nature only. No information contained in the publication constitutes the provision of securities advice. AssureInvest warns that: (a) in preparing the publication, AssureInvest did not take into account the particular goals and objectives, anticipated resources, current situation or attitudes of any particular person; and (b) before making any investment decisions on the basis of that publication, any investor or prospective investor needs to consider, with or without the assistance of a securities adviser, whether the information contained within the publication is appropriate in light of the particular goals and objectives, anticipated resources, current situation or attitudes of the investor or prospective investor. If the information contained in this document relates to the possible purchase of a financial product, the client should consider the relevant product disclosure statement (PDS) before making any decision.

Disclosure

AssureInvest has no debt or equity relationship with any funds management or financial advisory group. AssureInvest may have an interest in the securities referred to in the publication in that AssureInvest and/or its staff may hold or intend to hold deposits, shares, units or other rights in respect of such products and from time to time AssureInvest may provide some of the investment product providers mentioned in the publication with research, consulting and other services for a fee.

AssureInvest Pty Ltd

ABN 55 636 036 188 AFSL number 478978.

FREE Special Report: How to Jump ahead of competitors and add more value for clients

Learn how you can boost profits while enhancing customer outcomes.