AssureInvest’s direct equities portfolio management goal is to achieve attractive long-term returns at lower-than-average risk. We do this by investing in a concentrated and appropriately-diversified portfolio of attractively-valued outstanding businesses.

Here we discuss key elements of our successful, patient and disciplined approach and highlight some companies we have owned.

A steadfast commitment to our investment philosophy and structured investment process promotes the likelihood of successful outcomes while reducing the risk of permanent capital loss.

ASSUREINVEST’S EQUITIES INVESTMENT APPROACH

AssureInvest targets outstanding businesses, possessing sustainable competitive advantages leading to persistently high returns on capital, reliable cash flows and strong balance sheets. We believe an actively-managed portfolio built on outstanding businesses is more likely to preserve investor capital and generate superior returns over time.

Competitively-advantaged companies have assets or skills that are unique or extremely hard to imitate, setting them apart from rivals and allowing them to generate returns on capital in excess of the cost of capital. By reinvesting capital at high rates of return, these businesses become compounding machines, creating extraordinary value for investors over time.

Very few companies are able to generate high returns on capital for many years at a time. Most companies generate poor investor returns or even capital losses because they are prone to high levels of competition and therefore low margins, require high levels of capital investment which may not generate sufficient returns, or are battered by cyclical forces.

Outstanding companies benefit from a favourable power imbalance in their industries in relation to barriers to entry, competitive rivalry, strength of consumers, power of suppliers and degree of substitution of alternate products or services.

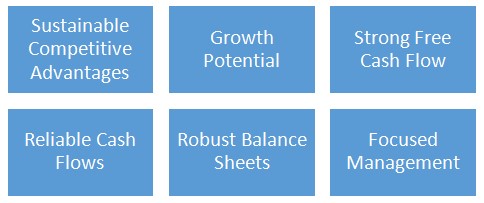

Outstanding companies we seek possess these highly desirable characteristics:

- Sustainable competitive advantages in one or more of the following areas:

- Cost advantages stemming from more efficient means to produce, sell and support products, often through greater volumes or better use of technology than competitors.

- Differentiation advantages through successful establishment of clear and valuable points of difference between their brands and others, importantly leading to pricing power and greater customer loyalty.

- Switching cost advantages, where customers are unwilling to change to a competing product because of excessive real or perceived costs of transition.

- Network effects, where the value to customers increases as more people use a product or service, such as in social media.

- Growth potential, often through producing strong returns on capital, selling to a growing market and benefiting from price increases over time.

- Strong free cash flow generation, that is, the funds remaining after payment of business expenses and required capital expenditure. Companies with strong free cash flow are more likely to internally fund growth without needing to raise additional debt or equity and are more capable of paying dividends or invest in new growth projects.

- Reliable cash flows, improving the ability to reliably assess company value. Cash flow predictability is determined by revenue cyclicality, operating leverage, balance sheet strength and risk of unforeseen events.

- Robust balance sheets through modest debt levels and strong earnings capacity.

- Focused management team determined to extend the company’s competitive advantages.

OUTSTANDING COMPANY CHARACTERISTICS

Company Examples

Here are examples of companies we have held in portfolios in the past and we may hold them now. Pricing is always a critical consideration as it impacts expected total returns. We continually seek positions in the small universe of outstanding companies offering the greatest value and this discipline may force other high-quality companies out of our portfolios for a time.

Brambles (BXB)

Brambles is a global logistics powerhouse with competitive advantages leading to sustainably high returns on capital. The business is likely to continue to compound high rates of return over many years, making it a wealth-creating machine.

Global scale in the pallet pool leads to cost advantages making it difficult for other suppliers to compete. Large capital expenditures are required to procure pallets and containers and support the extensive service-centre network. These undertakings would not be sustainable without Brambles’ balance sheet and cash flow capacity.

Brambles also derives network advantages as multinational retailers and consumer goods manufacturers find efficiencies by using the same logistics service supplier globally. The ability to provide global solutions to multinational retailers means some of them pressure suppliers to use CHEP pallets as a means to streamline their operations.

Failure of start-up rival iGPS recently in recent years is testament to high entry barriers protecting Brambles’ business.

InvoCare (IVC)

InvoCare is a market-leading funeral, cemetery, crematoria and related service provider in Australia, New Zealand and Singapore and has just commenced operations in the United States. With a reputation for high-quality, compassionate service and strong brand recognition built over many decades, there is a high degree of repeat sales within family groups for departed relatives. The company’s surveys show 98% of client families would recommend an InvoCare location.

Competitive advantages stem from strong brands under a number of banners, ownership of well-located properties in high-population areas and scale advantages, especially a sizeable balance sheet that funds modest acquisitions that add to the growth profile. Customer switching costs are high given the emotional nature of the occasion and family preference to follow a traditional path.

A highly reliable and growing earnings stream is one of the key attractions of this business. The number of deaths rises at a relatively constant rate over time and will be lifted by a growing and aging population. Weather and the severity of flu seasons have transient impact on the number of deaths. Increasing geographic diversity helps smooth annual regional variations.

Pricing power is demonstrated by annual price increases above inflation as families of the deceased typically prioritise trust and familiarity over cost. A growing proportion of funerals are prepaid which lifts the certainty of future earnings and provides funds for the company to generate income via investments.

Ramsay Health Care (RHC)

Ramsay Health Care is the leading private hospital operator in Australia and France with growing presence in United Kingdom, Indonesia, Malaysia and China. The company benefits in Australia and France from strong private healthcare take-up and in the United Kingdom from a shift to National Health Service (NHS) outsourcing. Impetus for a supportive private hospital regulatory environment is provided by the partial relief to the public healthcare funding burden within stretched government finances of the public healthcare funding burden.

Competitive advantages stem from costs advantages as scale boosts global buying power and the large balance sheet supports digestible acquisitions that extend growth prospects. Hospitals tend to be natural local monopolies as additional land for new facilities is hard to come by, plus medical specialists find it more efficient to be located at the same place. A trusted brand encourages repeat patient visits in favour of alternate health facilities. The company has a good record of managing the complexity of international healthcare systems and importantly has established a record of reliability and quality over a 50-year period.

Ramsay is well placed to benefit from growing and aging populations and rise of Asian middle classes. The United Nations estimates that the number of older persons has tripled over the past 50 years, and will more than triple again over the next 50 years. Innovations will also extend the variety of treatments that can be provided and therefore boost healthcare demand. There are also numerous opportunities to meet growing demand through lower-risk projects to expand existing facilities. Net 754 beds and 41 operating theatres will be delivered in 2015 and 2016, for example.

“I like businesses I can understand. It is not an easy business for competitors to enter. I look for a competitive advantage – cost, brand, share of mind is priceless (better than market share). How much could anyone hurt them if they had a billion or 10 billion dollars. If they can’t make a dent, I am in.” Warren Buffett

Contact Us

Let us demonstrate how we can deliver outstanding outcomes for you.

p +61 2 8094 8410

e [email protected]

About AssureInvest

AssureInvest is your trusted professional investment partner. We offer a holistic and successful investment approach and carefully tailored solutions for individual needs, as well as cost saving innovations, integrity at the highest level and attentive customer service.

Our advisor clients are empowered to boost their profits and deliver better investment outcomes, benefiting their clients and the broader community.

Our disciplined and long term focus provides a critical framework for assessing new value-adding opportunities, preserving capital, generating superior returns and implementing at low cost.

Copyright

Copyright © 2017 AssureInvest Pty Ltd ABN 55 636 036 188 (AssureInvest). All rights reserved. No part of this publication may be reproduced or distributed in any form without prior consent in writing from AssureInvest.

Disclaimer

AssureInvest has taken all care in preparing this presentation and the data, information and research commentary within it (together referred to as the ‘publication’) but to the extent that the publication is based on information received from other parties no liability is accepted by AssureInvest for errors contained in the publication or omissions from the publication. AssureInvest gives neither guarantee nor warranty nor makes any representation as to the correctness or completeness of the publication. AssureInvest bases its data, information and research commentary on information disclosed to it by other parties. Past performance is no guarantee of future performance. This publication is intended for Australian residents only.

General Advice Warning

The information contained within this publication is of a general nature only. No information contained in the publication constitutes the provision of securities advice. AssureInvest warns that: (a) in preparing the publication, AssureInvest did not take into account the particular goals and objectives, anticipated resources, current situation or attitudes of any particular person; and (b) before making any investment decisions on the basis of that publication, any investor or prospective investor needs to consider, with or without the assistance of a securities adviser, whether the information contained within the publication is appropriate in light of the particular goals and objectives, anticipated resources, current situation or attitudes of the investor or prospective investor. If the information contained in this document relates to the possible purchase of a financial product, the client should consider the relevant product disclosure statement (PDS) before making any decision.

Disclosure

AssureInvest has no debt or equity relationship with any funds management or financial advisory group. AssureInvest may have an interest in the securities referred to in the publication in that AssureInvest and/or its staff may hold or intend to hold deposits, shares, units or other rights in respect of such products and from time to time AssureInvest may provide some of the investment product providers mentioned in the publication with research, consulting and other services for a fee.

AssureInvest Pty Ltd

ABN 55 636 036 188 AFSL number 47897

FREE Special Report: How to Jump ahead of competitors and add more value for clients

Learn how you can boost profits while enhancing customer outcomes.