Whether intentional or not, every investor makes asset allocation decisions.

A portfolio 100% in cash is an asset allocation decision. There is no doubt asset allocation decisions need to be made, otherwise financial goals are unlikely to be met. Most importantly, effort is required to ensure the investment array is appropriate for each individual’s circumstances.

We believe the best way for investors to achieve their financial goals is through actively-managed, long-term investment in a diverse array of attractively valued higher-quality assets, implemented at low cost predominantly via transparent and tax-effective direct securities and exchange traded funds (ETFs).

Here we discuss how wisely-constructed multi-asset portfolios mitigate risks and smooth returns for investors, and we analyse the attributes of each key asset class.

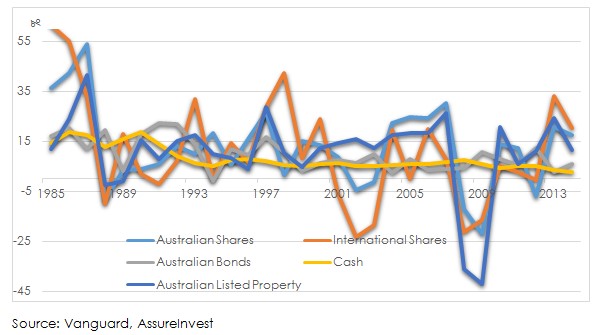

CHART 1: BENEFITS OF MULTI-ASSET INVESTING WITH ASSUREINVEST

Well-constructed multi-asset portfolios mitigate risks for investors, the equivalent of not putting all your eggs in one basket. Diversification is one of the keys to protecting capital along with focusing on high-quality assets and allowing a margin of safety before making buy and sell decisions. While we would love to have perfect foresight, that of course is not possible. AssureInvest utilises various proprietary methods for estimating longer-term asset class returns – cash, stocks, property, fixed interest – but there will always be a certain degree of uncertainty around these. Distributing assets in line with our strategies is a smart way to generate long-term upside while protecting against ruinous loss.

Diversification helps smooth returns over the longer-term and limit downside risk as various asset classes tend to behave differently over time. Equities and property values typically rise in value faster than fixed income and cash, but their returns are more volatile. Investors need to choose a long-term asset allocation framework based on their unique goals and risk tolerance and then tactically alter the weights between assets within specific ranges as market, economic conditions and specific investment opportunities change.

Many investors are not aware of the risks they are taking by not having an appropriately diversified portfolio. Some have very high weights to equities and are therefore exposed the risk of not being able to fund their lifestyle if equity markets fall just before retirement. Others have excessive weights to low-returning cash and fixed interest in order to reduce volatility, but run the risk of not building a large enough nest egg.

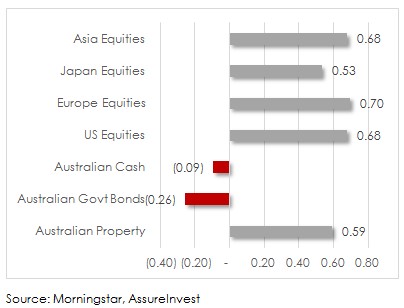

CHART 2: HISTORIC RETURNS OF CHOSEN ASSET CLASSES

Government bonds tend to provide valuable risk management attributes for long-term diversified portfolios as prices tend to be negatively correlated with growth assets. The long-term historical correlation between Australian equities and government bonds is -0.26, meaning for a 1% fall in Australian equities, bond values tend to rise by 0.26%. Equity and property prices typically rise during periods of stronger economic growth and (modest) inflation, while government bonds tend to rise when inflation is falling or the economic outlook is less certain.

Cash also has beneficial diversification attributes, having for example almost zero correlation to Australian equities. Cash is the least volatile of the asset classes and besides providing returns of its own, possesses valuable optionality in that it can be readily applied to transient attractive investment opportunities made available by the market.

Property provides investors exposure to rental returns and property asset prices which tend to be more stable than equity earnings and prices, notwithstanding the excessive rise of debt by many real-estate investment trusts in the lead-up to the global financial crisis which commenced in 2007. Equity and property markets tend to move in a similar direction over time, but typically not by the same magnitude.

Diversifying portfolios to international equity markets, held in combination with core Australian equity holdings, permits access to different regional economic forces with their various monetary and fiscal settings, the world’s strongest businesses and an array of currencies. As such, potential overall returns are enhanced, and volatility can be reduced over the long-term because each market is less than fully correlated. Risk-adjusted returns are therefore enhanced. Investing internationally also helps offset the strong bias to financials and resources sectors within Australia’s equity market.

Markets frequently appear cheap or expensive relative to their prospects based on fundamental income and growth factors. We have an active approach to portfolio management, meaning we tactically adjust our portfolio tilts to take advantage of market opportunities to reduce the risk of capital losses and enhance potential returns.

CHART 3: ASSET CLASS CORRELATIONS TO AUSTRALIAN EQUITIES

Buffett’s two rules of investing: “Rule No.1: Never lose money. Rule No.2: Never forget rule No.1”.

Contact Us

Let us demonstrate how we can deliver outstanding outcomes for you.

p +61 2 8094 8410

e info@assureinvest.com.au

About AssureInvest

AssureInvest is your trusted professional investment partner. We offer a holistic and successful investment approach and carefully tailored solutions for individual needs, as well as cost saving innovations, integrity at the highest level and attentive customer service.

Our advisor clients are empowered to boost their profits and deliver better investment outcomes, benefiting their clients and the broader community.

Our disciplined and long term focus provides a critical framework for assessing new value-adding opportunities, preserving capital, generating superior returns and implementing at low cost.

Copyright

Copyright © 2016 AssureInvest Pty Ltd ABN 55 636 036 188 (AssureInvest). All rights reserved. No part of this publication may be reproduced or distributed in any form without prior consent in writing from AssureInvest.

Disclaimer

AssureInvest has taken all care in preparing this presentation and the data, information and research commentary within it (together referred to as the ‘publication’) but to the extent that the publication is based on information received from other parties no liability is accepted by AssureInvest for errors contained in the publication or omissions from the publication. AssureInvest gives neither guarantee nor warranty nor makes any representation as to the correctness or completeness of the publication. AssureInvest bases its data, information and research commentary on information disclosed to it by other parties. Past performance is no guarantee of future performance.

General Advice Warning

The information contained within this publication is of a general nature only. No information contained in the publication constitutes the provision of securities advice. AssureInvest warns that: (a) in preparing the publication, AssureInvest did not take into account the particular goals and objectives, anticipated resources, current situation or attitudes of any particular person; and (b) before making any investment decisions on the basis of that publication, any investor or prospective investor needs to consider, with or without the assistance of a securities adviser, whether the information contained within the publication is appropriate in light of the particular goals and objectives, anticipated resources, current situation or attitudes of the investor or prospective investor. If the information contained in this document relates to the possible purchase of a financial product, the client should consider the relevant product disclosure statement (PDS) before making any decision.

Disclosure

AssureInvest has no debt or equity relationship with any funds management or financial advisory group. AssureInvest may have an interest in the securities referred to in the publication in that AssureInvest and/or its staff may hold or intend to hold deposits, shares, units or other rights in respect of such products and from time to time AssureInvest may provide some of the investment product providers mentioned in the publication with research, consulting and other services for a fee.

AssureInvest Pty Ltd

ABN 55 636 036 188 AFSL number 478978.

FREE Special Report: How to Jump ahead of competitors and add more value for clients

Learn how you can boost profits while enhancing customer outcomes.