“Give me six hours to chop down a tree and I will spend the first four sharpening the axe.” — Abraham Lincoln

Investors without a roadmap for success will find it very difficult to achieve their goals. An investment philosophy is a set of guidelines that inform investors’ decisions over time. By thinking through where they are going and how they plan to get there, investors are far more likely to have success.

A clearly written investment philosophy statement is a key communication tool for investment committees. It provides a critical central set of shared beliefs and parameters that can be referred to frequently, guiding all decisions.

An investment philosophy will not be able to predict unforeseen events like market crashes or personal cash flow shortages, but it will help guide a response when they do occur. Without an agreed approach, decisions are more ad hoc, inconsistent and more likely to end in poor performance.

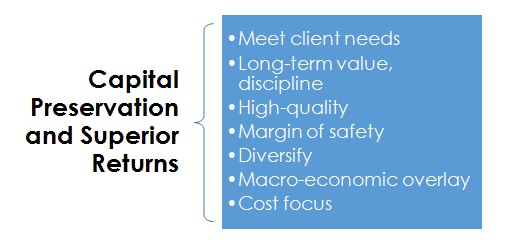

In this article, we discuss the key elements of AssureInvest’s investment philosophy, formed through investment theory, empirical evidence, practice and experience. Our philosophy is the source of our strong past performance and provides a critical framework for assessing new opportunities.

We believe our disciplined, dynamically-managed, long-term focus on diversified, high-quality and attractively-valued assets, implemented at low cost, is more likely to preserve capital and generate superior returns over time than other approaches.

ASSUREINVEST’S INVESTMENT PHILOSOPHY

MEET CLIENT NEEDS

A holistic approach to investment management is more likely to meet the unique needs of each individual investor.

Strategic asset allocations, or the investors’ very long-term portfolio plan, should be intrinsically tied to how investors’ think about risk and return. The specific portfolio design should be determined by investor-specific objectives and risk tolerance.

This analysis includes understanding the proportion of income versus growth-style assets that are suitable for the investor as these lead to very different portfolio outcomes. The right asset mix differs for each individual and is likely to change as investor circumstances change.

HIGH QUALITY

Investment goals are more likely to be achieved through an actively managed long-term focus on attractively-valued, higher-quality assets.

For equity investors with a patient attitude, it is better to target outstanding businesses that are more likely to outperform over the long term. Attractive businesses are able to continue to invest capital at high rates of return, thereby creating value over time. They possess sustainable competitive advantages through unique assets or skills and strong industry positions in relation to barriers to entry, rivalry, strength of consumers, power of suppliers and degree of substitution.

Companies with more predictable cash flows are also less likely to disappoint, will be more readily valued and will have less volatile share prices. Cash flow predictability is determined by revenue cyclicality, operating leverage, balance sheet strength and risk of unforeseen events.

It is wise to limit portfolio exposures to less reliable situations, for example enterprises based in emerging markets where liquidity, foreign exchange and political risks are higher and corporate governance structures are weaker.

Similarly, investors should limit exposures to commodity prices due to their characteristic volatility and poor predictability.

VALUE

Once investors have narrowed down the investment universe to select high-quality assets, potential returns can be boosted by seeking assets trading at attractive prices relative to their underlying fundamental value. Overpaying for assets can cause weak returns or capital losses.

To improve investment outcomes, dynamic investors adjust asset allocations based on their assessment of expected returns for each asset class in relation to the required returns. Required returns differ for each asset class according to their inherent uncertainty. Investors should require greater returns for higher-risk assets.

Within our direct equities investment process, we pinpoint companies trading at attractive prices via a variety of proprietary metrics including our detailed long-term forecasts of revenues, expenses and cash flows.

DIVERSIFICATION

Broad diversification, actively managed across asset classes and sectors, enhances potential returns and reduces the potential for permanent capital loss or unacceptable portfolio volatility.

Broad diversification, actively managed across asset classes and sectors, enhances potential returns and reduces the potential for permanent capital loss or unacceptable portfolio volatility.

- Domestic and international stocks, bonds, property, fixed income and cash tend to behave differently over time. Returns are likely to be enhanced and risk of permanent capital loss reduced by investment in a diverse array of attractively-valued higher-quality assets.

- The appropriate weighting between asset classes depends on the investor’s individual goals and risk tolerance, overlaid with the relative-return opportunities of each asset class.

- Disciplined investors oppose transactions that diworseify the portfolio by increasing the number of instruments held while not contributing to risk-adjusted returns. We are less concerned with tracking error, that is, the degree to which returns match market index returns, than helping clients achieve financial objectives and preserving capital. Quality and value are greater priorities than diversification, as long as the portfolio design sits within the investor’s broad strategic asset allocation range.

MACROECONOMIC OVERLAY

Macroeconomic analysis should help inform tactical asset allocation and equity portfolio tilts to ensure greater weighting to high-conviction opportunities. Fixed income asset allocations and duration and credit-quality exposures should be informed by the longer-term economic outlook and resultant interest rate expectations.

Key long-term global and local forces like aging western world populations and emerging Asian middle classes should inform security selection and portfolio weights. Click here to read our analysis of the five key longer-term themes that investors should consider when constructing portfolios.

MARGIN OF SAFETY

Application of a margin of safety in relation to buy and sell trigger points increases potential gains while reducing the chance of capital loss. To allow for characteristic uncertainties in forecasting asset returns, investors should buy at a discount to fair value. This provides a cushion against errors in the investment arithmetic. The appropriate discount, or margin of safety, is larger for more volatile asset classes and securities.

PATIENCE AND DISCIPLINE

A patient and disciplined approach with a steadfast commitment to our investment philosophy and process promotes the likelihood of successful outcomes while reducing the risk of permanent capital loss. A structured and methodical approach reduces the risk of error through emotion-led decisions.

LONG TERM

A long-term approach to investing gives asset prices the time to gravitate toward underlying fundamental value. With so much of the market focused on short-term gains, and with human instincts of fear and greed frequently causing asset prices to overshoot their underlying value, a different perspective offers opportunities to take advantage of mis-pricing in asset markets. The short-term focus of the majority of market participants means asset prices often reflect short-term factors more than longer-term fundamental factors.

A long-term approach allows investors to maximise the powerful benefits of compound returns. Time, return and re-investing are the sources of substantial fortune. As Albert Einstein famously professed, “Compound interest is the eighth wonder of the world. He who understands it, earns it … he who doesn’t … pays it.” By way of example: $10,000 invested at 9% per annum but paid out each year for ten years generates a gain of $9,000. Reinvesting each year’s return generates a total gain over ten years of $13,670, or 52% more than if the return is paid out each year.

A long-term approach also typically results in fewer transactions which boosts returns over time through lower transaction costs like brokerage and administration-related expenses.

SIMPLE AND CHEAP IMPLEMENTATION

- Investors should seek low product and implementation costs to boost returns. Product costs within our portfolios can be significantly below most investor portfolios through a focus on direct securities and exchange-traded-funds (ETFs).

- A low turnover nature reduces the administration burden for investors and advisors, and cuts brokerage and other transaction costs.

- Tax considerations should be given healthy regard including through longer holding periods and preference for tax-beneficial treatments like franked dividends, other things equal.

“The individual investor should act consistently as an investor and not as a speculator. This means that he should be able to justify every purchase he makes and each price he pays by impersonal, objective reasoning that satisfies him that he is getting more than his money’s worth for his purchase.” — Benjamin Graham

A version of this article was first published in SMSF Adviser Magazine.

Contact Us

Let us demonstrate how we can deliver outstanding outcomes for you.

p +61 2 8094 8410

e [email protected]

About AssureInvest

AssureInvest is your trusted professional investment partner. We offer a holistic and successful investment approach and carefully tailored solutions for individual needs, as well as cost saving innovations, integrity at the highest level and attentive customer service.

Our advisor clients are empowered to boost their profits and deliver better investment outcomes, benefiting their clients and the broader community.

Our disciplined and long term focus provides a critical framework for assessing new value-adding opportunities, preserving capital, generating superior returns and implementing at low cost.

Copyright

Copyright © 2016 AssureInvest Pty Ltd ABN 55 636 036 188 (AssureInvest). All rights reserved. No part of this publication may be reproduced or distributed in any form without prior consent in writing from AssureInvest.

Disclaimer

AssureInvest has taken all care in preparing this presentation and the data, information and research commentary within it (together referred to as the ‘publication’) but to the extent that the publication is based on information received from other parties no liability is accepted by AssureInvest for errors contained in the publication or omissions from the publication. AssureInvest gives neither guarantee nor warranty nor makes any representation as to the correctness or completeness of the publication. AssureInvest bases its data, information and research commentary on information disclosed to it by other parties. Past performance is no guarantee of future performance.

General Advice Warning

The information contained within this publication is of a general nature only. No information contained in the publication constitutes the provision of securities advice. AssureInvest warns that: (a) in preparing the publication, AssureInvest did not take into account the particular goals and objectives, anticipated resources, current situation or attitudes of any particular person; and (b) before making any investment decisions on the basis of that publication, any investor or prospective investor needs to consider, with or without the assistance of a securities adviser, whether the information contained within the publication is appropriate in light of the particular goals and objectives, anticipated resources, current situation or attitudes of the investor or prospective investor. If the information contained in this document relates to the possible purchase of a financial product, the client should consider the relevant product disclosure statement (PDS) before making any decision.

Disclosure

AssureInvest has no debt or equity relationship with any funds management or financial advisory group. AssureInvest may have an interest in the securities referred to in the publication in that AssureInvest and/or its staff may hold or intend to hold deposits, shares, units or other rights in respect of such products and from time to time AssureInvest may provide some of the investment product providers mentioned in the publication with research, consulting and other services for a fee.

AssureInvest Pty Ltd

ABN 55 636 036 188 AFSL number 478978.

FREE Special Report: How to Jump ahead of competitors and add more value for clients

Learn how you can boost profits while enhancing customer outcomes.