Activity has surprised on the upside. Growth is fading, but improving consumer sentiment, stable joblessness and reinvigorating housing markets imply mild slowdown rather than deep recession.

There is a possibility of a renewed inflation surge later this year requiring additional rate hikes which would be more destructive economically. However, a mild disinflationary path is more likely, thus encouraging a monetary pivot toward easing in the second half of this year, preceding more robust economic expansion through 2025.

The global services purchase managers index (PMI) remains firmly in expansionary territory despite recent mild softening. Global manufacturing is now above the mark of 50 indicating growth after being weak for more than a year. Further expansion is likely given rising real incomes and completion of inventory drawdowns now post-pandemic supply chains are more free.

The United States has been supported by better-than-expected consumption, business investment and construction along with fiscal stimulus through a budget deficit as high as 6% of gross domestic product (GDP). Europe has been particularly soft due to weak consumption, manufacturing and export demand. China activity has begun improving but remains weighed by property troubles.

Resilience is supported by strong private sector balance sheets and low borrowing costs for debt locked in at low interest rates in 2020 and 2021. This impact has been more substantial in economies like the US where mortgage rates are typically fixed for thirty years. Higher prevailing rates will have greater impact on new or rolled over debt. Monetary policy is a more immediate force in Europe and Australia where debt is typically variable.

The recent period has exaggerated wealth inequality as large firms and wealthy households have been more resilient to higher rates while lower socioeconomic groups struggle against higher costs of living and more punitive rates on credit card debt.

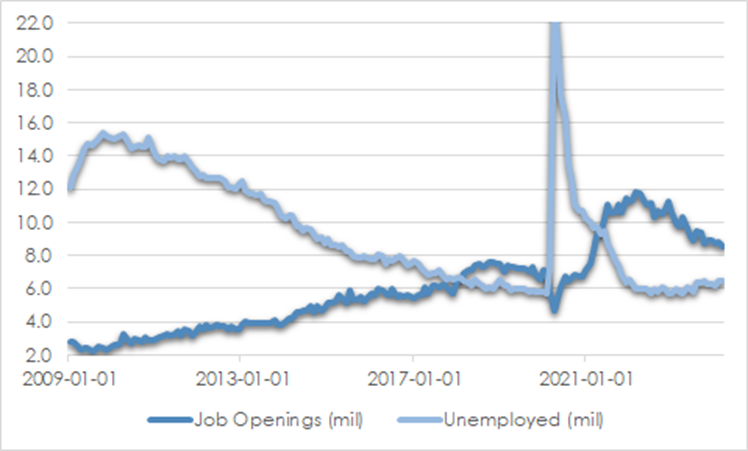

Of significant surprise is the continued strength in labour markets which remain tight despite the rate hikes in the last two years. The 175,000 additional jobs in the US in April 2024 were less than recent months but comfortably above longer-term averages. Claims for unemployment benefits have barely budged while participation has been rising because of the increased work opportunities.

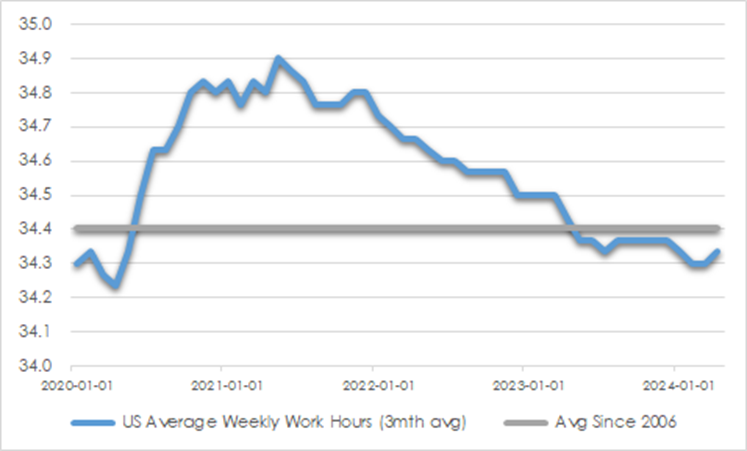

There appears to be a higher degree of labour hoarding by employers given the troubles they have had finding staff with suitable skills. These challenges were exacerbated by the swathes of retirements and other changes to individual work habits during the pandemic. Participation remains below pre-pandemic levels in the US. The number of hours worked has declined in the last year. The number of job openings continues to far outnumber the number of unemployed people.

CHART 1: US JOB OPENINGS VS UNEMPLOYED

Source: St Louis Fed

CHART 2: US HOURS DECLINING

Source: St Louis Fed, AssureInvest

Inflation stubbornly above target

Inflation continues to decline while remaining above target levels. Goods inflation has fallen more than services, helped by more efficient global supply chains and softer energy and food prices. Exported low inflation from China has helped goods inflation fall through the large volume of exports internationally. Chinese inflation may be relatively mild for several years but is likely to increase from current weakness as global manufacturing advances and China’s economy gains momentum.

Services inflation is taking far longer to cool because of tight labour markets. Mismatches between jobs and skills have encouraged businesses to retain staff through higher wages. Unemployment in many economies remains around the low levels before the pandemic. US average hourly earnings growth of 4.4% annually is significantly above longer-term average. There will be an ultimate slowing in wages and services inflation as activity cools and unemployment lifts, but this pace will vary across different economies. Housing undersupply is pressuring rents upwards particularly in countries with immigration upswings and building shortages but lifted construction should help this ease in the next year or so.

The moderation in inflation is being slowed by structural factors like geopolitical tensions which are encouraging division of the global economy, the increased emphasis on the reliability of supply over efficiency and the transition to lower carbon intensity.

Monetary pivot milder than previously expected

Central banks are likely to begin cutting rates in the next few months, though the quantum of easing this year will be less than that expected a few months ago. Central banks will be concerned about cutting too quickly and allowing inflation to regain momentum. On the other hand, leaving rates high for too long could prompt a sharper downturn in activity than may have been necessary.

US policy will naturally become more restrictive as inflation fades. However, several factors imply that financial conditions are looser than may be immediately obvious, such as tight credit spreads, elevated stock market values, increased budget deficits and investment in decarbonisation. The path to easier policy is likely to be gradual as inflation is taking time to recede. There could be more economic pain ahead than many expect. US rates may be cut by 50 basis points in the second half of this year. A further 100 basis points in cuts are likely in 2025.

Monetary easing this year is likely to be more significant in Europe than the US. There is little evidence of overheating in Europe. The European Central Bank is likely to start cutting rates in June, and by 100 basis point by year end, to avoid an excessive fall in activity and inflation. European labour markets appear reasonably tight, but businesses could cut staff dramatically if demand underperforms expectations.

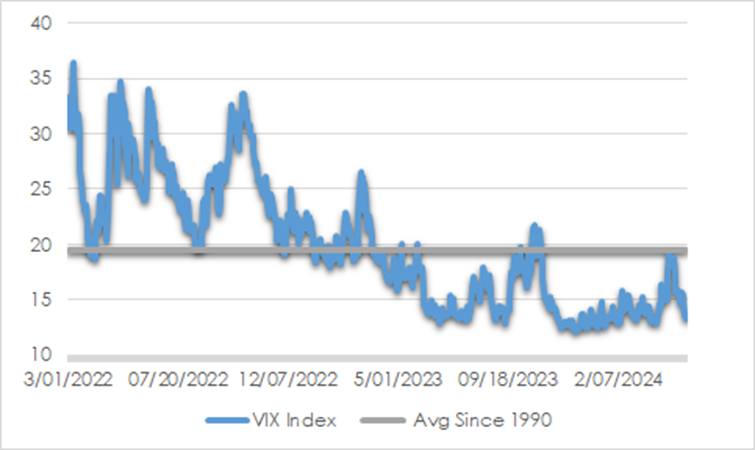

Investment strategy

Given the uncertainties, financial markets volatility is remarkably low while credit spreads and other assessments of risk tolerance are surprisingly tight. Markets are exposed to economic pathways that become too strong or too weak. Cash is increasingly our friend as we build liquidity to better withstand inevitable turbulence and ready us to purchase high-quality assets at more attractive prices.

CHART 3: US VIX VOLATILITY INDEX

Source: CBOE, AssureInvest

It is crucial for investors to hold diversified exposures across assets, regions and sectors. The challenge in finding outright value in markets encourages a further shift up the quality spectrum.

Despite the likely pick up in volatility, positive equity returns are supported by slowing but still expanding economies, moderating inflation and eventually receding interest rates. Heightened valuations restrict the returns that might be expected over the forecast horizon. No more than a neutral exposure to equities can be justified. Our overweight to Europe is premised on relatively attractive valuations, faster falling rates supporting consumption and improving global economies assisting recovery in manufactured goods. The US houses some of the strongest businesses of all time, but our modest underweight reflects overexuberance that leaves many stocks priced for perfection. Our preference for larger capitalisation stocks remains despite the valuation advantage of smaller companies given the latter’s higher debt levels and sensitivity to economic cycles. Our neutral Australian equities position includes recently added cash which is ready to be applied opportunistically during sporadic market events.

We remain underweight the fixed income asset class with shorter duration than benchmark along with only modest weighting to mainly higher-quality credit securities. We expect Australian rates to be held steady for an extended period. Australian policy is only mildly restrictive while an increasing proportion of heightened inflation is derived domestically and from stickier services items. A further rate hike is more likely than a rate cut in the near term though no change is the most likely. Credit spreads are surprisingly tight, both relative to history and to the possibility of a near-term economic weakness that should not be underestimated.

Andrew Doherty. AssureInvest

The Information constitutes only general advice to wholesale investors. In preparing this document, AssureInvest did not take into account your particular goals and objectives, anticipated resources, current situation or attitudes. Before making any investment decisions you should review the product disclosure statement of the relevant product and consult a securities adviser. Past performance is no guarantee of future performance. This document is not intended for publication outside of Australia.

FREE Special Report: How to Jump ahead of competitors and add more value for clients

Learn how you can boost profits while enhancing customer outcomes.